Airline tickets are hitting near-record revenue levels of $805 billion for 2023, according to the International Air Transport Association (IATA). Despite inflation and overall economic uncertainty, travelers are flocking to airports across the globe, with many airlines like LATAM Airlines, Lufthansa, and United Airlines reporting skyrocketing ticket sales as Q2 came to a close..

The Travel industry is slowly recouping costs from the pandemic years, which put massive dents in profit margins. Even more so, customer service notoriously took a hit with airlines experiencing labor shortages paired with increased demand — a recipe for customer dissatisfaction. With 86% of consumers choosing to leave a brand they trust after only two poor customer experiences, the pressure is on to create a responsive and stress-free experience across the board — and airlines are no exception.

According to United Airlines CEO Scott Kirby, the gap still exists between customer satisfaction and what airlines have to offer to create smooth experiences for their customers. In an interview with Fortune, Kirby stated, “We believe the industry capacity aspirations for 2023 and beyond are simply unachievable” due to a lack of investment in technology in conjunction with insufficient pilot staffing.

Today, social media remains one of the critical channels through which airlines can gauge and elevate customer satisfaction. To understand how airlines have fared on social media during a year of unprecedented growth, Emplifi analyzed key social media metrics for global airlines across their official social media pages, comparing how they performed during the same January-July window from 2020 to 2023 on “X” (formerly known as Twitter), Instagram, and Facebook.

Here are some of the key findings we found in our analysis.

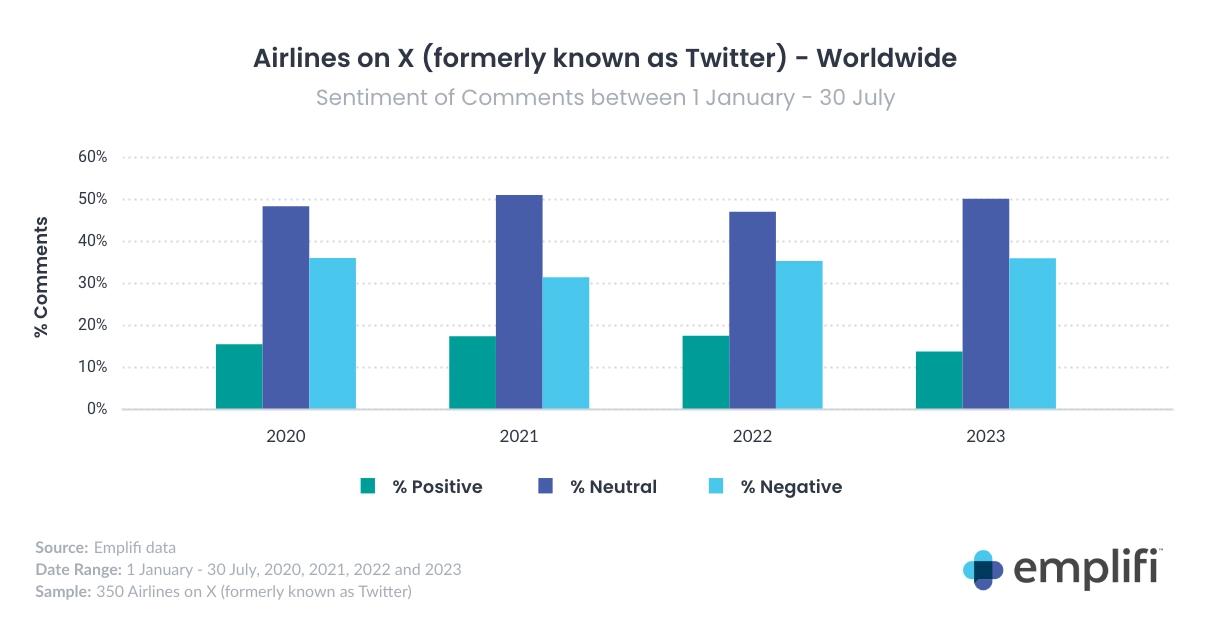

Negative sentiment on comments directed at airlines continues to dominate on Twitter

Traveling can be a high-stress situation for airline passengers, who can face many challenges, such as weather, lost luggage, flight delays, and more. This often leads passengers to look for quick answers via social media. Twitter (now known as “X”) has long been used as a source for real-time customer support, which makes it perfect for airlines that have to solve customer queries in the moment.

Interestingly, negative sentiment has remained stable for global airline brands from 2020 to 2023, hovering at 31-36%. In contrast, positive sentiment on public airlines tweets has dropped by 21% when comparing 2022’s performance to 2023.

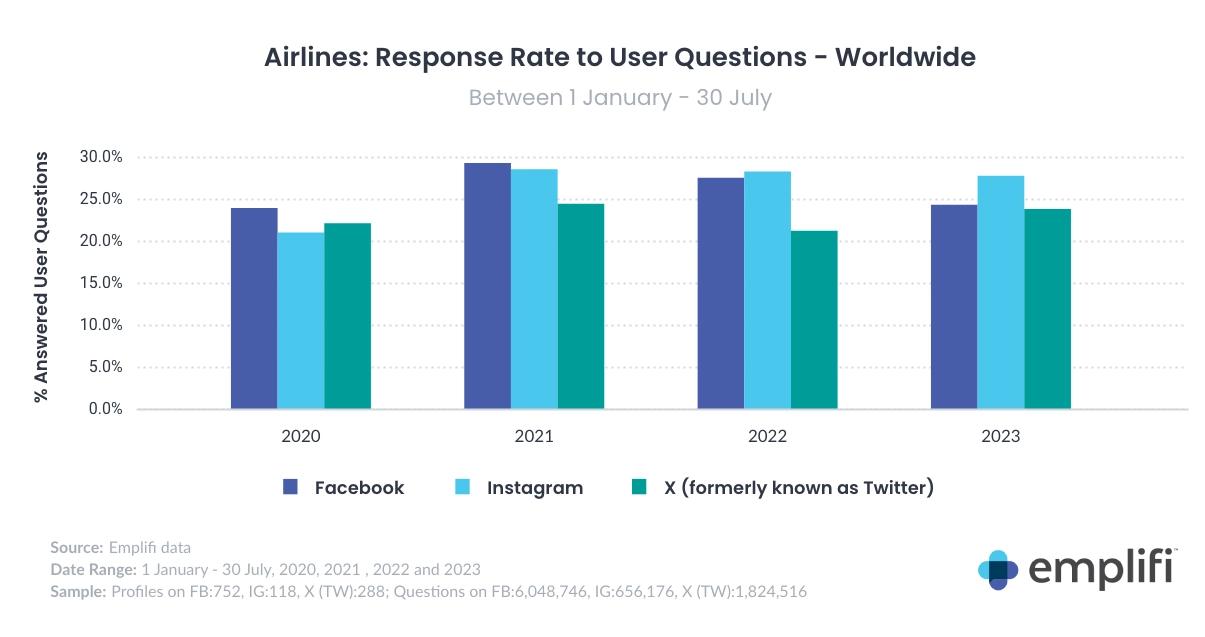

Airlines' response rate sees improvement after pandemic but remains stagnant

While it’s clear airlines have a social care strategy in place, there’s been little improvement throughout the post-pandemic years. Following the chaos of COVID-19, 2021 was the best year for airlines in responding to user questions, racking up an average response rate of 27% cumulatively across platforms. This was the largest jump in percentage of user comments answered, with a 22.6% increase.

However, when it comes to the percentage of questions answered on social media platforms, there weren’t noticeable discrepancies between the various platforms in 2023. On average, 25% of public questions received via comments are answered, leaving a whopping 75% of questions unanswered.

Despite a low response rate, airlines are quick to respond to customers on social media

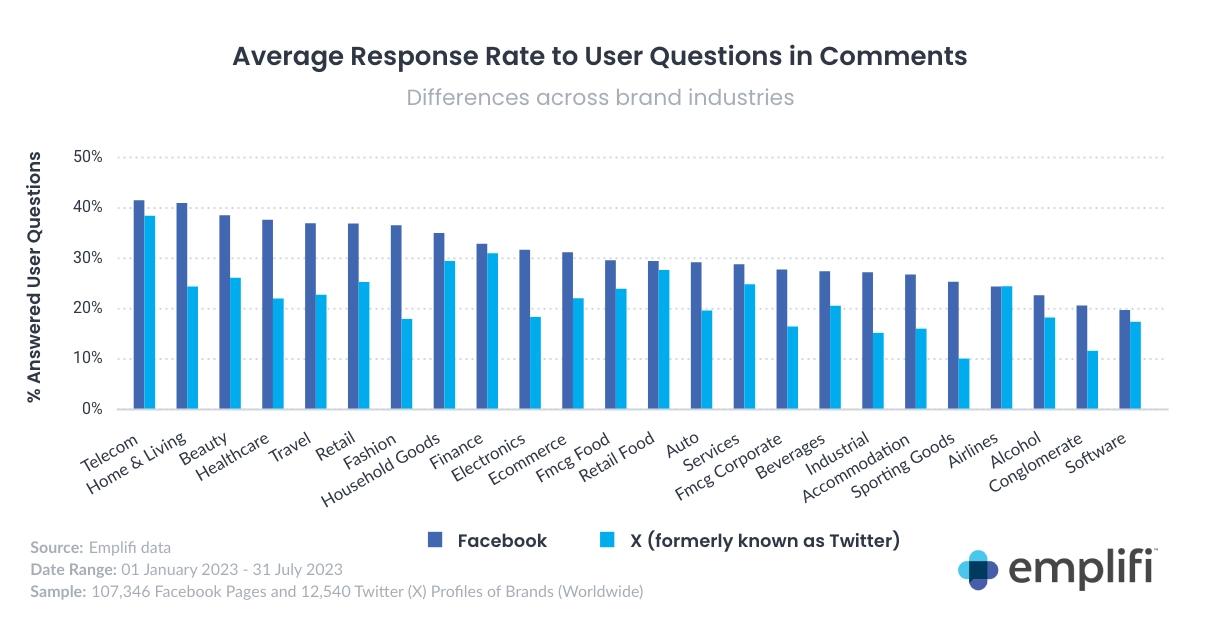

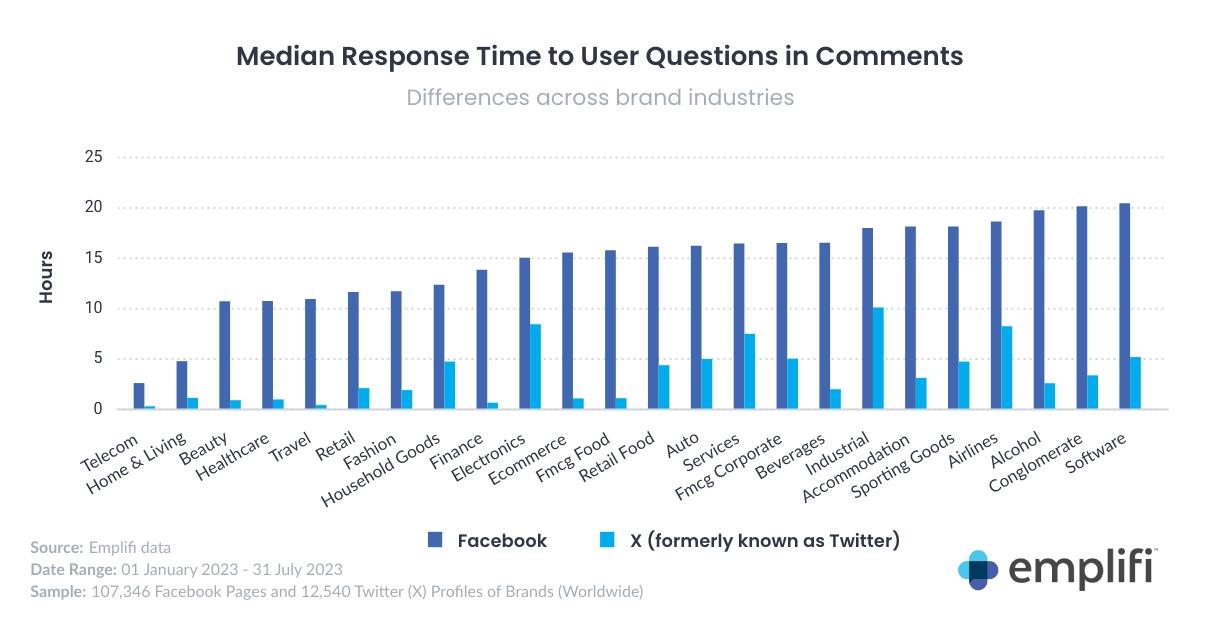

When compared to other industries, the airline industry falls on the lower end of the social customer care spectrum, answering 24% of questions on both X and Facebook in 2023 — a rate 40% lower than Telecom, the top-performing industry.

Though the overall percentage of questions answered by airlines may be lacking, the airline industry is one of the strongest when it comes to the speed at which they answer customer questions on X (1.2 hours) and Facebook (4.8 hours) — coming second only to Telecom brands.

While travel increases during the summer, the number of questions sent to airlines via X slows

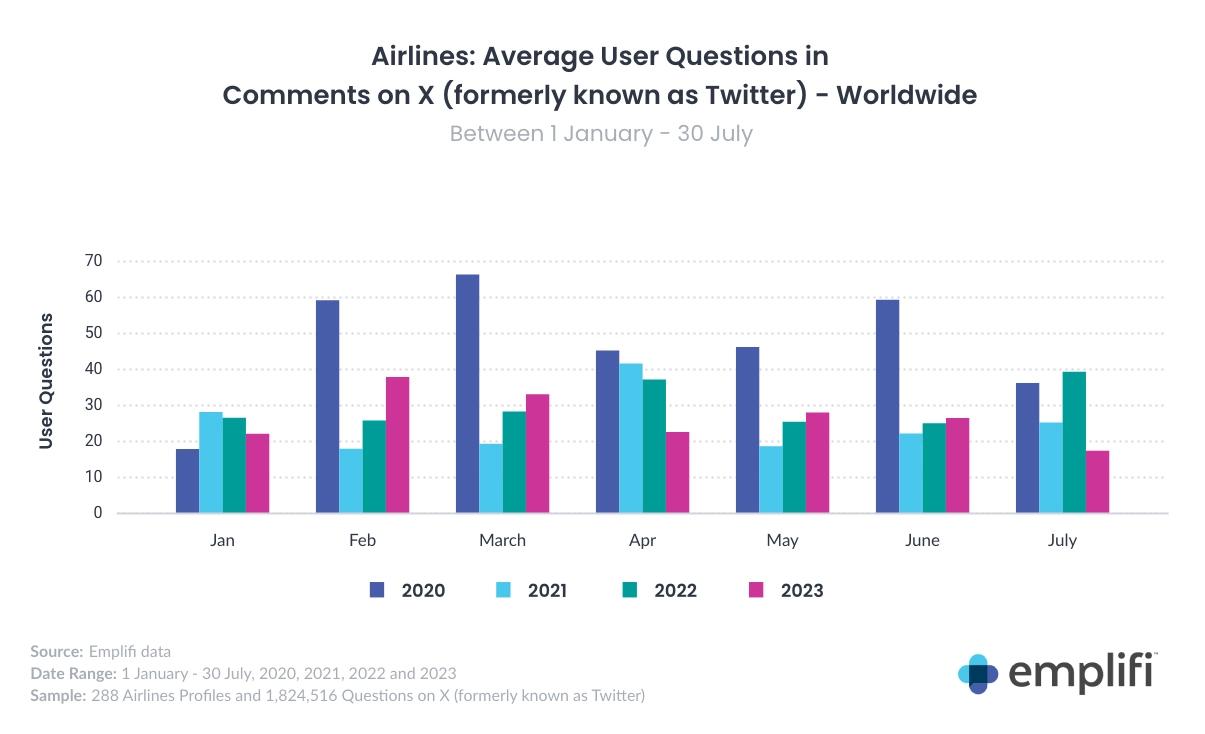

Unsurprisingly, 2020 (at the start of the COVID-19 pandemic) saw the number of questions sent to airlines via Twitter (now “X”) reach new heights as confused passengers turned to social media to receive answers. The peaks of answered user questions closely aligned with the pandemic lockdowns and travel restrictions for the early months of 2020.

Summer is often considered the high season for the airline and travel industry. Despite this, July saw the lowest number of questions sent to airlines on X in 2023. In contrast, February saw the highest number of customer questions for the same year. This aligns with the IATA’s report of international travel rising by 89.7% for the month of February 2023 year-over-year.

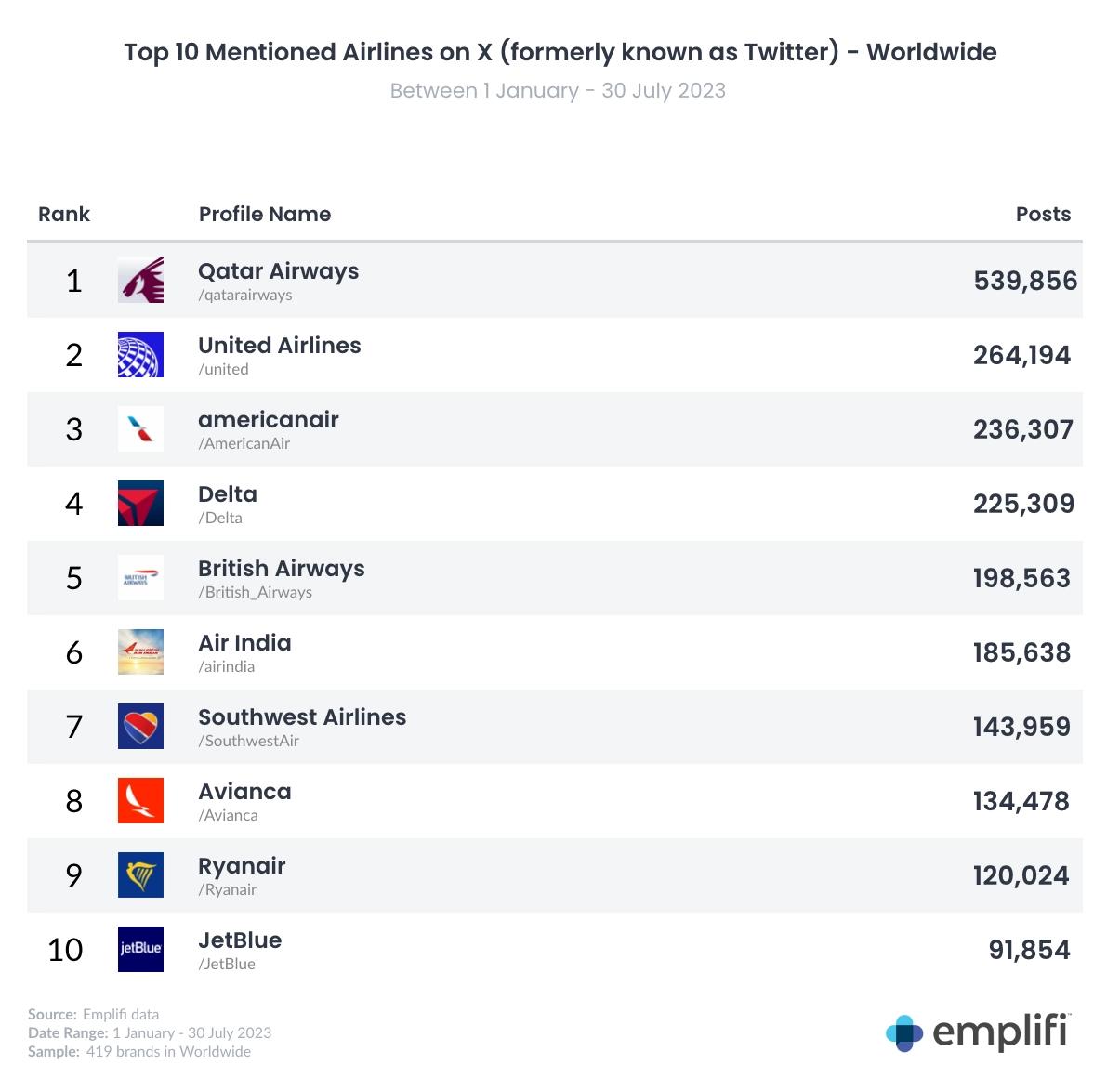

A look at the most mentioned airlines on X in 2023

From January-July 2023, Qatar Airlines collected the highest number of mentions on X worldwide, followed by three US-based airlines in United Airlines, American Airlines, and Delta. With US airlines taking the top four spots for the world’s busiest airlines, it’s unsurprising that they would also be the world’s most mentioned on social media.

The takeaway

Airlines should seek out strategies to expand their operations effectively in order to uphold high levels of customer satisfaction. Employing messaging technology like bots could play a pivotal role in minimizing the number of unanswered queries.

Although brands may feel they comprehend the importance of top-notch customer service, do they truly grasp the speed at which customer expectations are evolving? Maintaining a keen awareness of customer sentiment is crucial for delivering a seamless, timely, and exceptional customer service experience. As those leading in customer experience understand well, exceptional interactions foster advocacy, fortify customer loyalty, and ultimately boost profitability.

About the methodology

Comments made to brands from 107,346 brands on Facebook and 12,540 on X (formerly known as Twitter) were analyzed from January 1-July 30, 2020-23. No direct messages were analyzed, as this is a private metric that is unavailable. Industries with less than 50 profiles in the sample were excluded. Only user comments including "?" are considered as questions.