No matter what kind of business you have, you will be facing competition. These might be older, more established companies with loyal clientele and a legion of fans on social media, or they might be new competition coming out of the woodwork trying to destabilize your place in the market.

Getting the edge over your competitors is absolutely essential if you want your business to succeed, but that’s easier said than done – just knowing who they are and what they sell isn’t enough to beat them.

This is where social media competitive analysis and competitive intelligence come in. What exactly is social media competitive analysis, and how do you collect the relevant intelligence? How do you use it? Read on to find out.

What is competitive analysis and why is it essential?

Competitive analysis is the collection and analysis of competitor information and intelligence on their business behaviors, customers, and more.

It has long been a mainstay of business practice, and crucial for your business’s success. But with the advent of social media and web analytics, the way you should conduct a competitive analysis report has changed.

These days you will have to look to more sources of information than you would have in the past. On the bright side, this also means that the information you are able to collect on rival firms has expanded dramatically - allowing you to build a very detailed profile of who your competition is, where their weaknesses are, and how you can exploit them to get ahead of the game.

Note that competitive analysis isn’t some kind of shady espionage. You won’t have to rifle through anyone’s drawers or piece together shredded receipts for the information you need. There is a staggering wealth of valuable, publicly available data that you can tap into with the right tools and guidance.

Another important thing to keep in mind when planning to do a social media competitive analysis is that you shouldn’t just be thinking of your immediate competitors. To really get the edge, you’ll need to expand your research and benchmark your performance against your industry and region.

The benefits of competitive analysis

The benefits of conducting a comprehensive social media competitive analysis are impressive. From identifying rival firms and fine tuning your strategy, to benchmarking your performance and getting ahead, social media competitor analysis will touch every aspect of your business performance and potential success.

Measure and finetune your strategy

By running a social media competitive analysis, you’ll be able to compare and contrast key aspects of your competitors’ strategies and gauge how well your own strategy is performing in different social media environments.

See where you rank

You’ll also see where you rank in your market, your region, or your industry. This is a great way to pinpoint your immediate competitors, especially if you’re using it to look at social media platforms and where you rank on each.

Tailor your paid strategy

In line with this, it’s also good to keep track of the content your competitors are promoting, and where. You’ll be able to see how paid-heavy their strategy is and work to either match it or work around it.

Pick up on useful market trends

Another major benefit of your social media competitor analysis will be in spotting and making use of market trends. With the right tools, tapping into the wealth of data social media can provide you with can allow you to look beyond your present, put your performance into context, and help you build a picture of your future.

This can allow you to stay ahead of the curve in what’s ‘in’ and what’s falling out of style so that your content stays fresh and engaging. It will also allow you to avoid potential gaffs - and in an environment where any errors are very, very public, and mistakes can be screenshotted, the importance of this perk can’t be overstated.

To make the most of this particular benefit you’ll need the right social media competitor analysis tools. Namely a social media listening tool, and a source of content inspiration that you can rely on to spark your creativity and keep you in-the-know when it comes to what others in your market are publishing.

Put your performance into context

This data comes together to allow you to track your performance in tandem with your competition - allowing you to look beyond your individual performance and put your data into context.

Let’s say, for example, that your engagement has been dropping lately. Just looking at your own data you might assume you’re doing something wrong. But comparing your data to content from your competitors can show you if that assumption is correct or if something else is happening.

Let’s say that you see their engagement has been dropping too. This may point to algorithm changes affecting your reach, rather than mistakes on your part.

Make smarter strategic decisions and investments

With a comprehensive social media competitive analysis report, you will have a better view of the playing field and be better placed to make informed and effective business decisions for better investment and strategy.

Many companies underestimate the importance of social media competitive intelligence, but with a well-defined and ongoing data collection strategy, the information you’ll have at your fingertips is invaluable and priceless.

Competitive insights like these are one of the key elements that can take your business decision-making from good to great. You’ll be able to adjust where needed to catch up or shore up your lead to stay ahead of the competition.

How to do a social media competitive analysis

Start small

When you’re getting started with your competitive analysis, it can seem like a monumental task. Don’t get lost in all the things you could be doing - it’s ok to start small with your analysis and slowly build on the data you have.

It’s more important for your data collection to be accurate and relevant. So let’s get started with your immediate surroundings and go deeper as you expand your analysis.

Start with your immediate competition. These would be the competitors you are likely already actively working to beat.

This is an important stage because it’s a stepping stone to a more comprehensive understanding of what your competition really looks like.

You’ll want to categorize your competition into a few key groups:

Primary competition

These are your most obvious competitors. They are targeting the same audience you are, and/or they have a similar product to what you are selling.

Secondary competition

These are competitors who are not quite in direct competition, either by the audience they target or the product they offer. Often these are businesses that offer a high-end or low-end similar product, or potentially businesses that offer a similar product, but to a different audience.

Tertiary competition

Tertiary competitors are not your direct competition, but they are businesses that may still take up market share or become a problem when you want to expand your business or product range in the future. If you have a business selling plants, a tertiary competitor might be a florist.

Each competitor will have different advantages and disadvantages, and it’s important that you understand their performance in a multidimensional way.

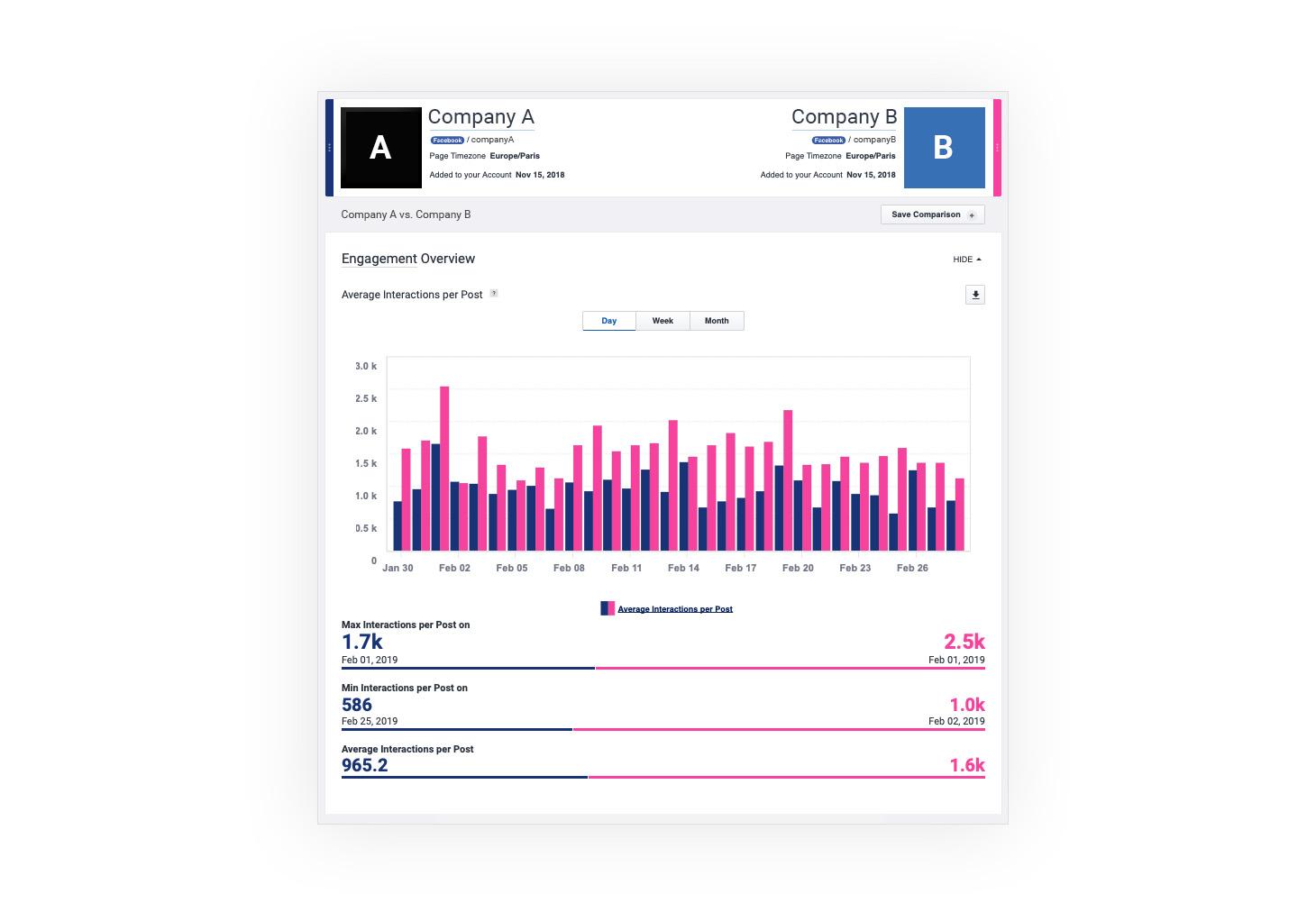

Here you can make use of some excellent online tools. In particular, you’ll want to get your hands on a robust tool for head-to-head comparisons of your business against the competition.

Once you have identified other businesses in your space, categorize them and map out the strengths that make them a threat to your business, along with the weaknesses that you can exploit to gain the upper hand.

You’ll also want to delve into their market position a little more. Find out who their customers really are, and what drives them to purchase from your competition. Is it price? Quality? Convenience? Compare your findings to the marketing copy they publish to decipher more information about their strategy.

One sneaky way to gather even more information is to sign up for whatever newsletters and educational content they have. You should also follow their blog and track their social media.

You can even purchase their product to see their buyer’s journey and user experience are like. Or start the buyer’s journey and then abandon it. If it’s an online retailer, for instance, you can put an item in your cart, then leave the site and wait to see if they have an email series set up to encourage you to return to your purchase.

Every piece of information you collect like this is something you can leverage in the future to improve your own market position.

Expand your analysis

After your immediate competition, it’s time to expand your reach and understanding of the playing field.

One great place to get started here is by doing a similar comparison to what you started with - but with a larger set of your competitors all at once. You could do this manually, but thankfully you won’t have to - with Emplifi head-to-head comparisons, you can select up to ten competitors at once for an immediate and comprehensive view of how you stack up.

In this comparison stage, you will also want to increase the scope of your analysis to look at more than just your immediate surroundings.

Look for competition within your industry and region - and maybe even spend some time thinking about areas you might have missed in your first pass, like competitors who might be conducting business in other languages. These are businesses you might miss with searches in only your native language, but they could still be eating up market share.

Another way to find competition you might have missed initially is by looking at your audience’s affinities. By this we mean the pages and brands your followers and customers also like. Sometimes these are harmless, and they can be an excellent opportunity to learn how to reach your audience more effectively, but you may also discover that your audience is also flirting with one or more of your competitors!

If you haven’t run a target audience analysis yet, you’ll definitely want to do that as well.

Dig deep with benchmarks

At this stage of your social media competitor analysis you’ll want to benchmark your content performance against a wider set of industry, regional, and market players.

Dive into both your paid and organic benchmarks to really get a feel for what’s working and what’s not - in context.

On the organic side, go platform-by-platform for a multidimensional view of your content’s success on social media vs. your competition. Connecting your social media to an inclusive, all-in-one social media management platform is the easiest way to consolidate this data, but there are also free social media competitor analysis tools that can help you out.

One thing to keep in mind though is that it’s not just your image and text content that’s important to benchmark. Videos are becoming increasingly important across every social media network, and it’s imperative that you benchmark your video performance against that of your competition as well.

On the paid side, it’s your ads and promoted posts that you’ll want to be keeping track of. Compare costs with other businesses in your industry and region with ads benchmarks.

But why not take it a step further? Dig up the posts your competition is promoting to get a feel for their strategic goals and the type of content you’re up against.

Benchmarking your paid strategy against the competition is an excellent way to improve and make informed business decisions around your promotions - with a more comprehensive view, you’ll be able to reduce costs and improve click-through rates.

How to optimize your performance with social media competitive analysis

Once you’ve collected the data from your social media competitive analysis, it’s time to put it to use.

First things first: identify the areas of your strategy that are performing well and where you are falling behind.

Here you will want to look into the areas of your strategy that are underperforming and consider how best you can improve - your new data should help you see where and why you are not performing quite as well as you need to be and assist you to improve those areas.

Do you need to improve your content? This is not just a question of quality. Even good content will perform badly if parts of it aren’t tailored to your audience - consider tone, the information you are publishing, and even the format.

Let’s say you have an interesting data set. Would it perform better as a bitesize infographic or as an informative article? There’s no overall correct answer, it’s all down to what your audience would be more interested in engaging with.

What about your paid strategy. Based on the data you have collected, do you need to update and re-optimize the copy?

But don’t rest on your laurels with the parts of your strategy that are succeeding! Even the areas you’re doing well in can always be improved with new data.

Once you’ve gone through the full social media competitive analysis report process and updated your strategy, it’s important that you go back to check in on your progress regularly. You can do this by comparing your latest results to those of your competitors to see if your efforts at improving your strategy are paying off.

You also want to be running through a full social media competitive analysis report regularly to update the information you have on your competitors and their market position. You need to know if new players have shown up and what your competition has been up to since you last studied them.

The takeaway

Social media competitive analysis is the bread and butter of a successful marketing strategy and should be an integral part of your business decisions. Use it to understand both your competitors’ performance as well as your own, all in the context of your industry and regional market.

When you’re looking for the data you need, a comprehensive social media management tool with analytics and listening capabilities is your most valuable asset, but there are some excellent free social media competitor analysis tools available as well to help you out.

Editor's Note: This article was originally published on socialbakers.com. Any statistics or statements included in this article were current at the time of original publication.