Solutions for teams

Product Modules

Customer Success Stories

All stories

Benefit Cosmetics

The beauty brand’s audience-first approach to content

Toyota

Driving customer engagement with deep insights

Kimpton Hotels

Why UGC is a critical part of their guest experience

Stanley

How the iconic brand increased product reviews and engagement

Freshpet

Streamlining customer interactions across channels

Hardee’s

Using social listening to capitalize on trending moments

Bath & Body Works

How the retailer is growing their community

Aeromexico

How the airline became one of the most loved travel brands on social

Industries

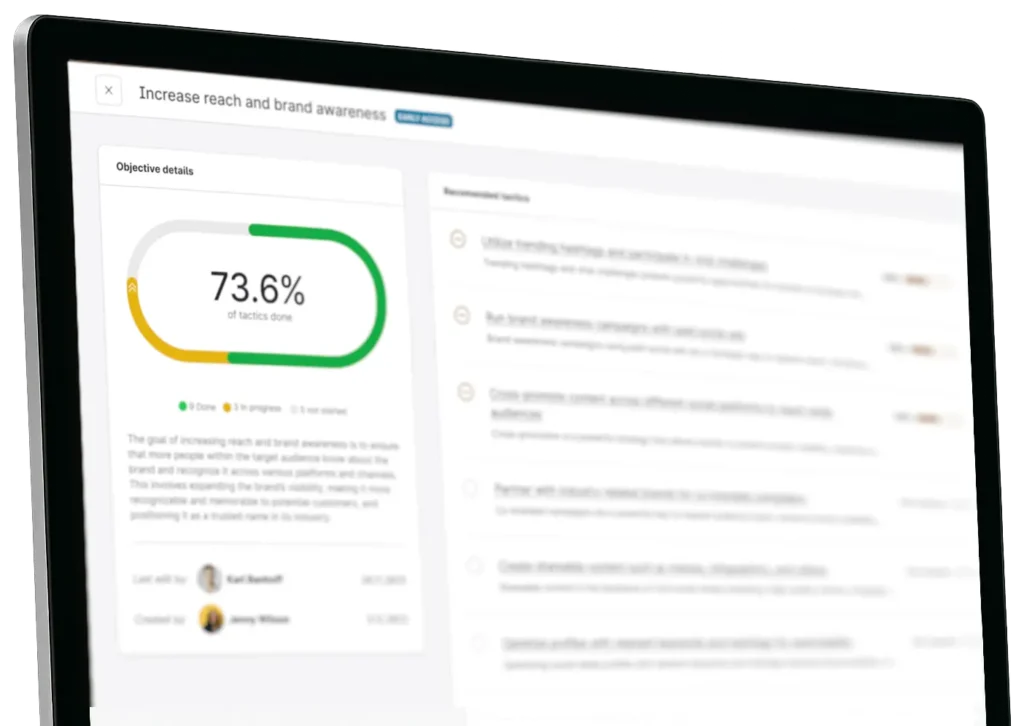

Outpace your competition

We’re recognized as a market leader in innovation and for our drive to give brands all the tools they need.

Insights

Resource Center

Your resource center for everything social marketing, commerce and care

Blog

Get up to speed on the latest trends, tips, and best practices to power your strategy

Webinars

Latest insights on marketing, commerce, and care, straight from the experts

Product Tours

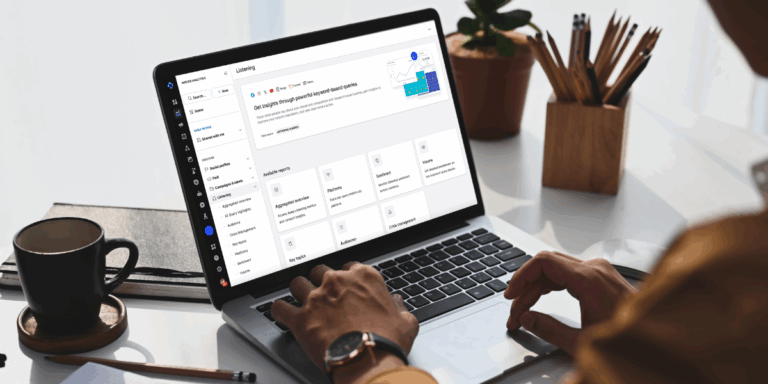

Explore our product tour library and interactive demos to see Emplifi in action

Quarterly Industry Benchmarks

Compare your social media performance with global and regional industry benchmarks

Key Terms Glossary

Explore our key term definitions

Customers

Company Information

About Emplifi

Emplifi provides brands with insights needed to empathize with customers and amplify the right experiences.

Pricing

Explore our plans and pricing for social media marketing, commerce, or care.

Careers

Learn about working at Emplifi and find the perfect role for you.

Events

Discover upcoming events to inspire your social media and CX strategy.

Leadership

Learn about our team of experienced executives driving innovation at Emplifi.

Media & Press

Keep up to date with news and insights from our newsroom.

Agency Partners

We partner with industry-leading marketing and advertising agencies to deliver unmatched client success.

Technology Partners

Our marketing technology partners are the world’s most trusted platforms, tech solutions, and service providers.

Security, Privacy & AI