Audiences are increasingly turning to influencers to learn about products and gain advice on decision-making. It’s interesting to see how Finance influencers have risen in popularity, especially with the Gen-Z crowd.

In fact, a recent survey indicated that 93% of teens believe they need financial knowledge and skills to achieve their life goals. And, rather than turning to traditional means to acquire that education, they seek out stock market advice and general financial tips from digital influencers. Why? They are relatable and authentic, which is exactly the type of content that resonates with this audience.

To meet the demands of this Finance-curious generation, influencers on Instagram and YouTube have stepped up their content game. With the increase of subscribers and followers on these channels, it’s clearly working.

In these times of economic uncertainty, with high inflation and a possible looming recession, Finance influencers on Instagram and YouTube are growing at record speeds. Finance brands can learn a lot from these growing trends, seeking relationships with the right influencer to help get their message out to a generation that will soon have enormous buying power.

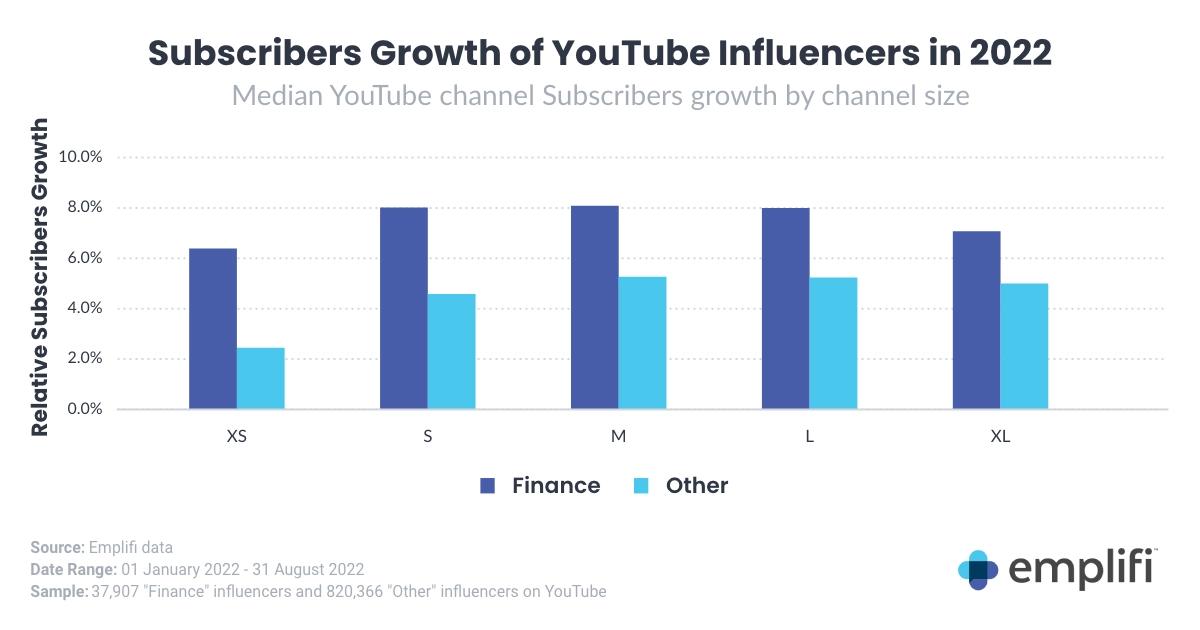

Finance influencers take the lead on YouTube

According to Emplifi data, Finance influencers on YouTube experienced an 8% median growth rate between January and August 2022, while all other influencers had less than a 4% median growth rate. When looking at median growth by channel size, Finance micro-influencers (XS = under 10,000 subscribers) had triple the growth rate of other micro-influencers.

The number of videos published by Finance influencers on YouTube was vastly greater than those published by other influencers. This was true across the board, regardless of account size. Finance influencers with 10,000 or fewer subscribers posted more than double the videos compared to other influencers with the same subscriber numbers. Between January and August 2022, the median number of videos published by Finance influencers with a million or more subscribers quadrupled the number of videos published by other macro-influencers.

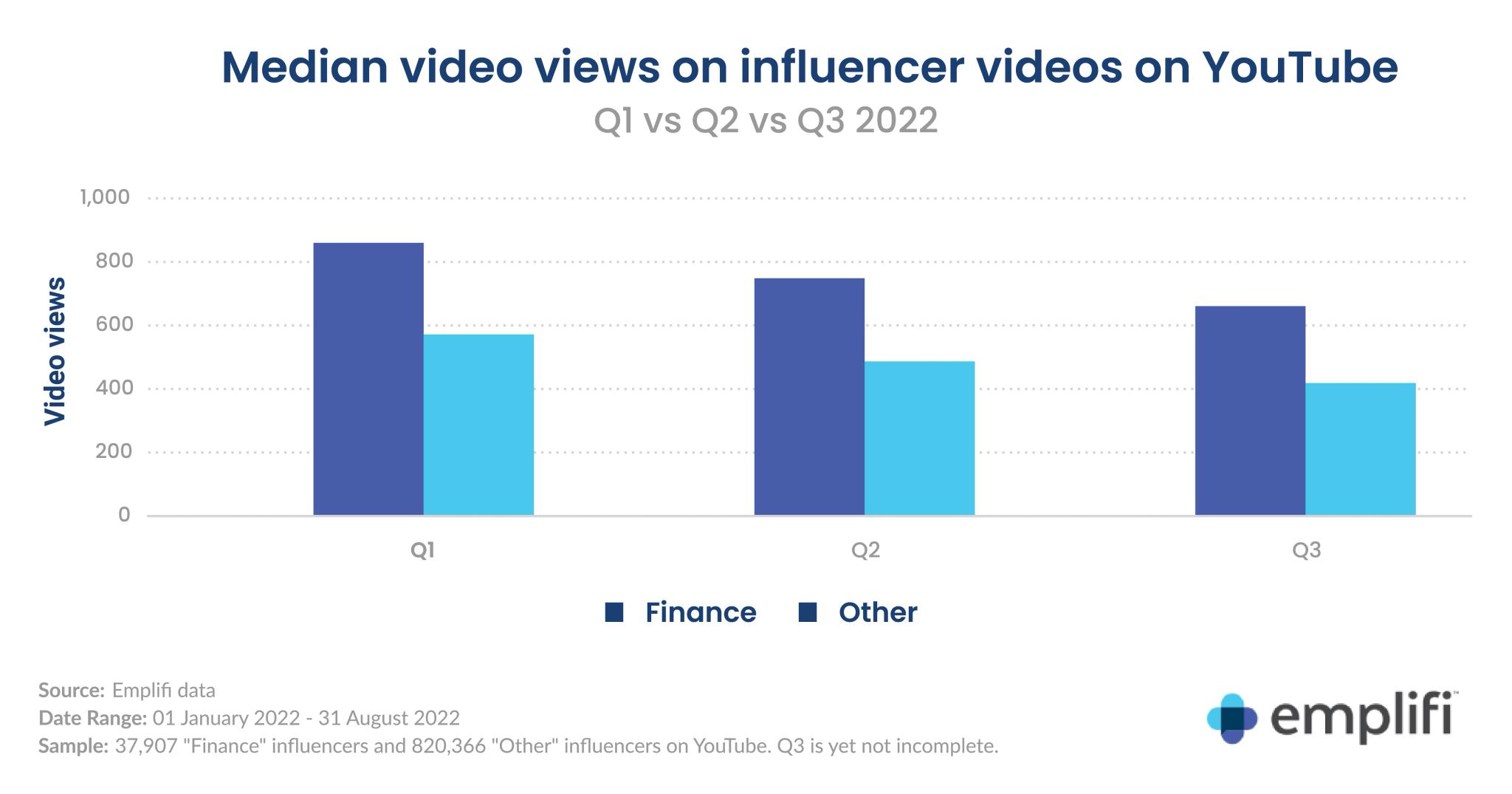

More importantly, Finance influencers received significantly more median video views compared to other influencers across Q1-Q3 2022:

Instagram sees surge in posts published by Finance influencers

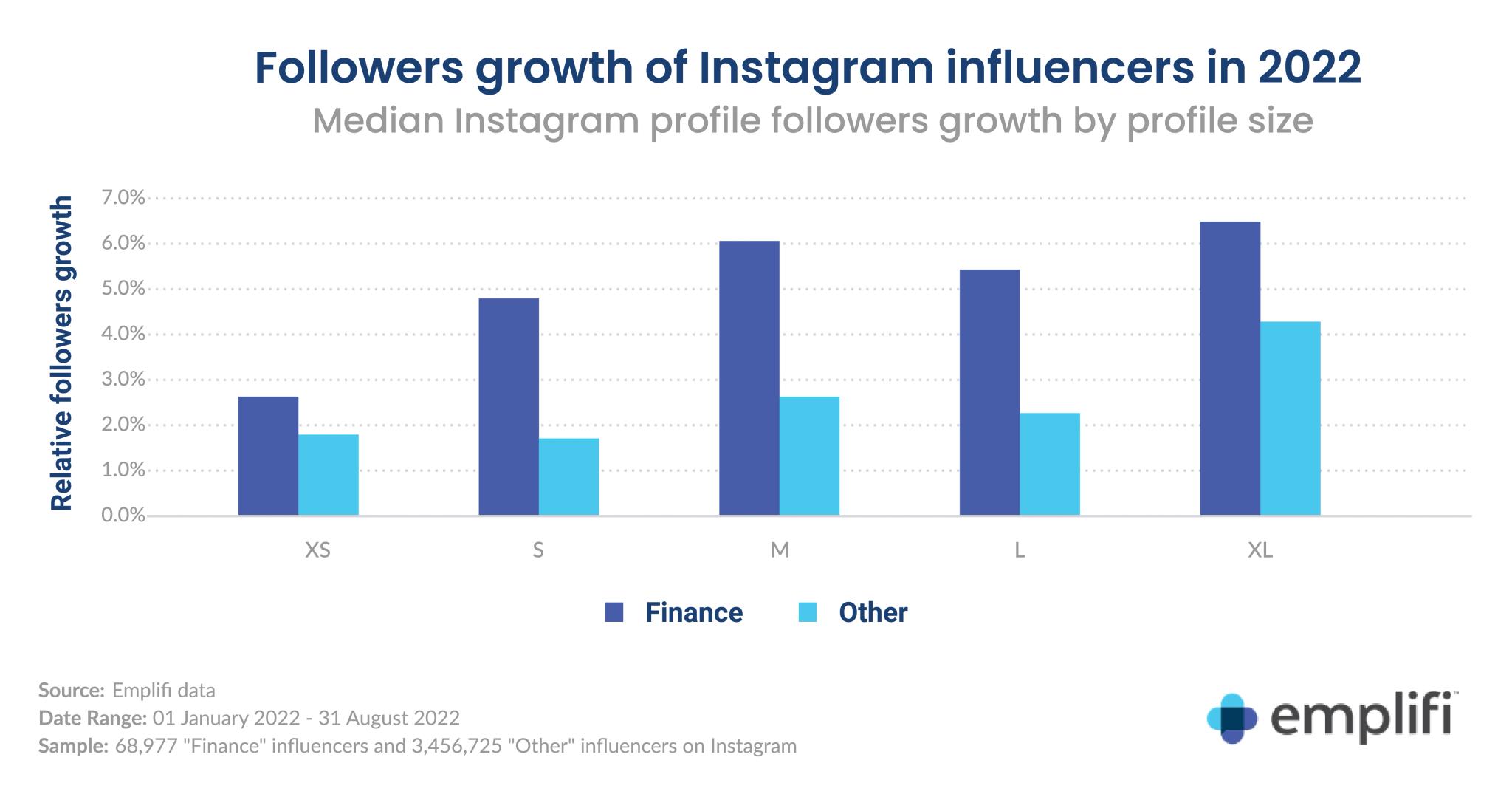

Like YouTube, Finance influencers on Instagram are experiencing tremendous growth compared to other influencers on the platform, with median growth rates considerably higher for finance influencers than those outside the Finance space. This is true across all influencer account sizes – from influencers with less than 10,000 followers to those with a million or more followers.

Finance influencers on Instagram are also publishing more than double the number of posts than other influencers. Finance influencers with a million or more followers are publishing as many as three to four times the number of posts as other influencers with the same number of followers.

While Finance influencers are posting considerably more content than other influencers on Instagram, non-Finance influencers have garnered more median post interactions than finance influencers every quarter so far this year.

Key takeaways

According to eMarketer, 75% of U.S. marketers will leverage influencers in their marketing campaigns this year, up five percentage points over 2021 — and it’s not just influencers with over a million followers entering brand relationships. Gartner reports marketers are paying more attention to micro and nano influencers (influencers with 10,000 or fewer followers).

Influencers play a vital role in marketing campaigns, and their influencer marketing efforts are only expected to keep growing in popularity as younger generations continue to seek out content from influencers that deliver the authentic, unfiltered content they crave.

Editor's Note: Learn more about this topic and analysis in this press release.