Customers today, especially from the Millennial and Gen Z generations, often prefer to get product advice from friends, people they can relate to, and influencers on social media rather than brands. While some social users are exposed to product and service recommendations through the TikTok or Instagram algorithm, for example, others actively head to these apps to discover brands from people they trust — the crux of influencer marketing.

In financial services, though, there's been some hesitation over bringing in influencers as affiliates. Financial advice can be a tricky subject, as qualified advisors go through years of training and often charge high rates. It's easy to see how working with untrained online personalities could be a problem.

Yet, over the last few years, financial topics like budget management and debt have become bigger talking points on social media. So has investment, with hashtags like #stocktok and #crypto garnering over 5 billion views on TikTok.

What is a finfluencer?

New financial influencers — or "finfluencers" — have grown in popularity along with trending topics like cryptocurrency. The term covers any influencer whose main topic is money management. That includes those talking about managing personal finances, as well as investment-focused influencers.

This has become such a popular source of financial information that the North American Securities Administration Association (NASAA) has come up with its own definition of finfluencers:

"A finfluencer is a person who, by virtue of their popular or cultural status, has the capability to influence the financial decision-making process of others through promotions or recommendations on social media”

Why are finfluencers growing in popularity?

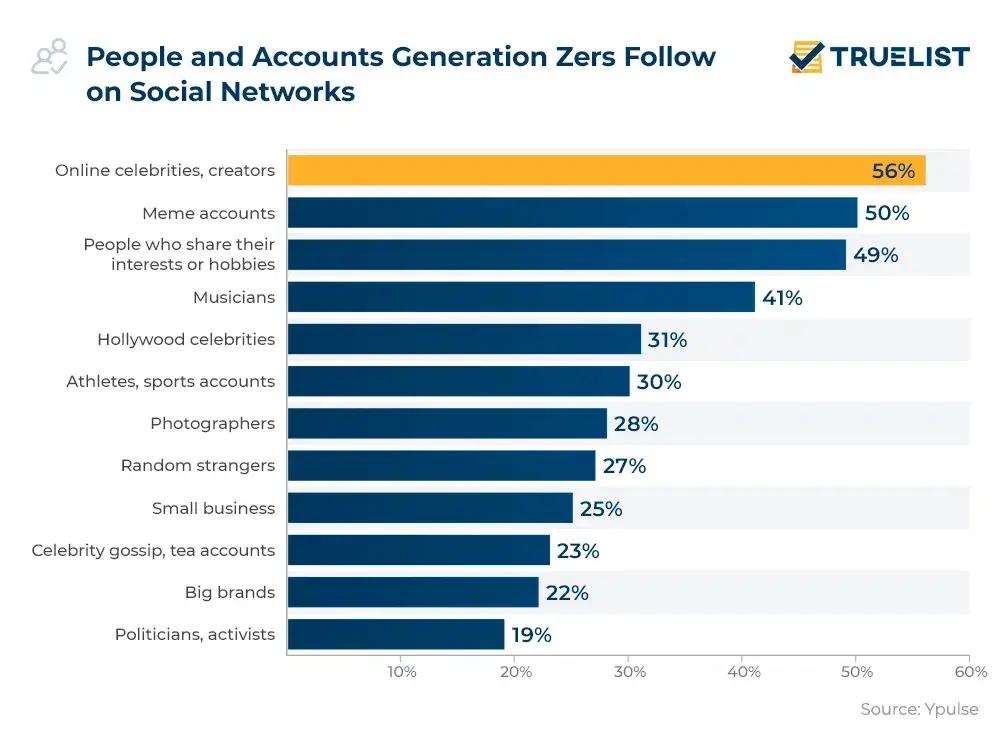

Finance influencers have grown across social media platforms like TikTok, Twitter, and Instagram. Some have managed to attract millions of followers. They've built up an engaged audience of social users, typically under 40 years old, the same way that brands often do.

Image Sourced from truelist.co

Financial information and product details can be a lot to digest. Influencers tend to relate these products to personal stories and experiences that their followers can relate to and understand. These finfluencers are essentially showing their community members that money management can solve specific goals and doesn't have to be as daunting as it may seem. After all, everyone has to manage their personal finances to some extent.

Gen Z and Millennial investors

As the Millennial and Gen Z audiences mature, their spending power as investors is growing. At the same time, economic pressures mean that money management and finance are now important topics for this audience.

The fact is that these groups get their product advice from social media, and they may prefer to follow personalities rather than brands or finance companies. So, you can see why financial services should be considering influencer marketing as part of their digital strategy.

Trust and public accountability

As social media use has grown, so has the potential for scams and fraud. Social media was listed as the initial form of contact for 27% of fraud reports in 2021. This has left users who rely on social media looking for verified and trusted sources of financial information.

But this hasn't slowed the growth of financial influencers. In fact, it seems to have accelerated the success of finfluencers with a large following and a track record of good advice. Social signals have proven to be a strong influence on younger audiences' trust.

Social media platforms like TikTok and Instagram have an investment in keeping scammers off their apps, too. Their reputations depend on accountability and authenticity, so algorithms and verification methods are developing all the time.

Can finfluencers give reliable financial advice?

At this point, you may be questioning whether or not social media influencers know what they're talking about when it comes to finance. Aren't there laws about who can give financial advice? Well, yes. Influencers generally aren't qualified financial advisors, so they can't give financial advice, but there are some ways around this.

Education, not advice

The legal definition of financial advice is pretty specific. So, not everything you might think of as advice actually qualifies. An influencer talking about a financial product or giving information about investments is fine.

In fact, some popular influencers like Milan Singh have built their brand around the principle of "Education, not advice." The idea is to help their audience pick up financial skills that they might not otherwise encounter. This is perfect for financial services marketers. It works well if, for example, you want to educate your customer about the HMRC transition to handling tax digitally. By providing an accessible guide for your clients on making tax digital software you can convey more information than a standard ad and get closer to your audience.

Overall, finfluencers can be used as a stepping stone to drive your customer down the funnel. If they're getting the basics and general advice from the creators they follow online, they're likely to also trust those influencers' recommendations for financial services, products, and companies.

The rising finfluencers of TikTok and Instagram

With the popularity of financial influencers on the rise, there are a lot of these creators. They're spread across different social media sites, too. TikTok and Instagram have been two of the most successful avenues for finfluencers. Creators also tend to cross-promote content through YouTube and Twitter.

Here are four of the most influential names across all platforms:

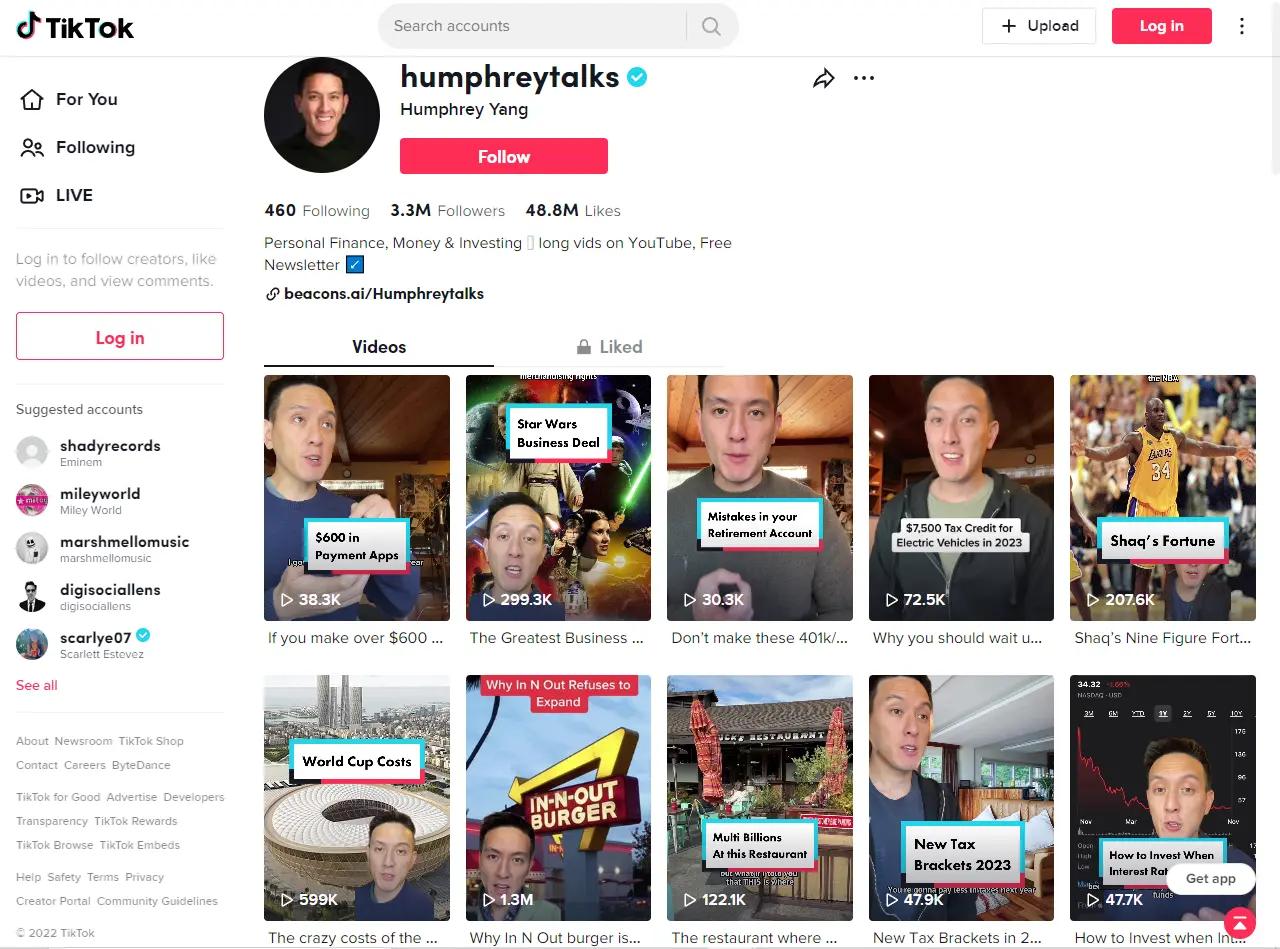

Humphrey Yang (@humphreytalks)

With 3.3 million followers on TikTok, Humphrey Yang's style of "financial life-hacks" are popular with beginner investors. He approaches topics that are relevant to the average viewer. He presents them in short videos with catchy titles like "Don't make these 401k/IRA mistakes."

Yang's background as a financial advisor gives him a unique insight into investment. At the same time, his short-form content is digestible even to inexperienced viewers. That's why he's managed to gain significant followings on YouTube and Instagram, as well as TikTok.

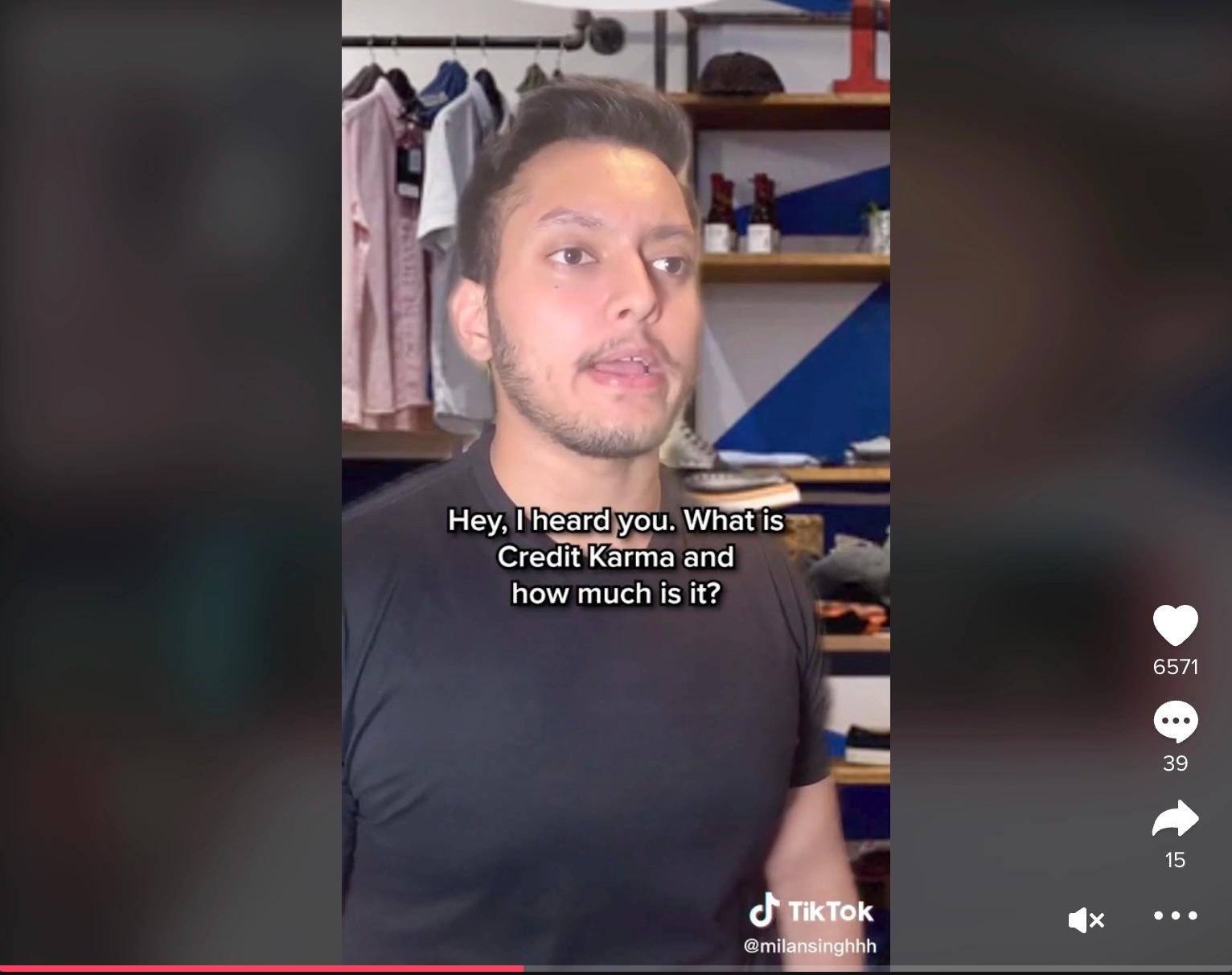

Milan Singh (@milansinghhh)

Milan Singh makes short videos on everyday finance. Videos answering questions like how to choose a credit card have earned him 2.6 million TikTok followers and counting. His content is short, simple, and to the point.

Delyanne Barros (@delyannethemoneycoach)

Former attorney Delyanne Barros has grown a large following across Instagram, TikTok, and Twitter. Her motto is "teaching investors how to slay the stock market" and her content focuses on motivation and advice on how to handle investment.

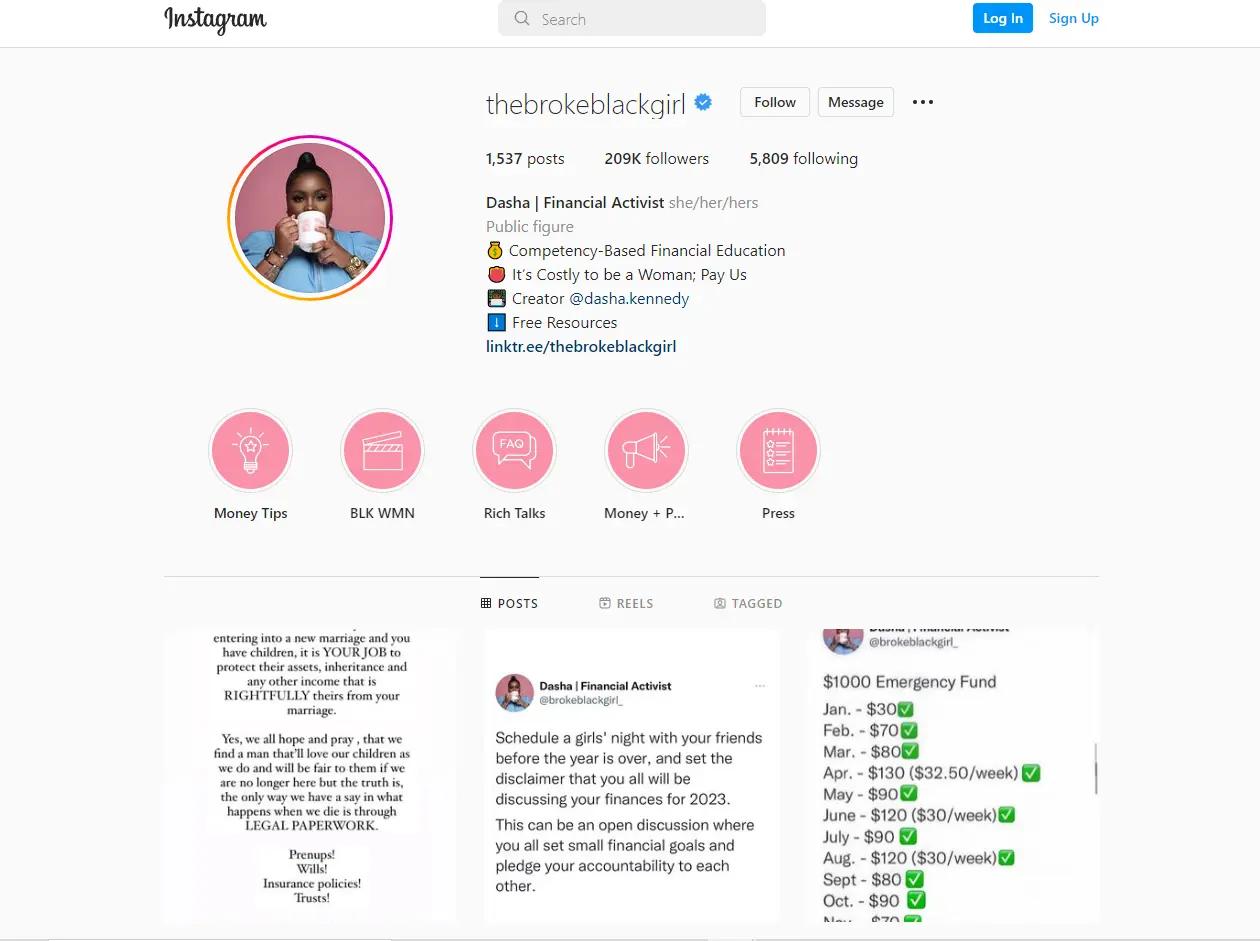

Dascha Kennedy (@thebrokeblackgirl)

Dascha Kennedy is an example of a finance influencer who takes a different approach. She focuses on managing personal finances, escaping debt, and achieving financial independence. These are relatable topics for many, and her Instagram account alone has more than 200k followers.

How can companies in the finance industry work with finfluencers?

The benefits of influencer marketing for financial services go beyond just additional channels to advertise through. They offer a way to connect on a more personal level with your audience, reach new demographics, and work with creators that match your brand's values.

Millennial and Gen Z investors have shown a tendency to back products and brands that match their ethics. Social responsibility, environmental impact, and sustainability are major influences on their purchasing decisions.

Before we dive into the benefits of influencer marketing when it comes to finance, it's worth noting that discovering creators to partner can present its own challenge. Check out our guide on how to find influencers for your brand for background on where influencers seek out brand partnerships and what avenues they prefer to communicate on.

Affiliate marketing

By working with influencers that embody your brand's values, you can extend that association to your consumers. Digital banks including Klarna and Moneybox have explored partnering with TikTok content creators, and others are following suit.

Creative digital marketing initiatives like Plum's "52-week saving challenge" can generate significant engagement. Working with influencers who are well-known on the platform means you can lean on their knowledge of their audience to create relatable content.

Customer education

Explaining a financial product to a customer is difficult at the best of times. Most people will get distracted or confused after a couple of minutes. That's why working with influencers who can make products, apps, and investment options relatable is a valuable tool for customer education.

For example, it can be incredibly useful if you're looking to explain self-assessment tax return software to your audience in a concise and easy-to-understand way. You can break down a complicated topic into easily digestible chunks, educating your clients about things that are important for them to know.

Social media presence

Working with finance influencers lets you expand your brand awareness without significantly ramping up your advertising spending. While you'll have expenditure on sponsorships or affiliate revenue, it's comparatively little even compared to social media ad placement.

Digital marketers working with finance products aren't limited to financial influencers, either. If the tone and values of an influencer match your brand, then you can reach wider audiences by partnering with influencers in the social space, too.

Remember Milan Singh, the influencer we mentioned earlier? This #ad for Credit Karma attracted 1.7 million views from his followers. It explains what the app is and why it could be useful in an everyday situation, all in under 30 seconds.

In this way a creator can relate the software or product to their own personal experiences. That, in turn, resonates with the audience who have a need for the product. Then, all you have to do is provide them with a path to purchase.

This is all hypothetical, of course, but it serves to highlight the unique marketing opportunities that working with influencers can open up.

Remember that there are legitimate concerns over inappropriate financial advice. Regulators in different territories have already begun looking at influencers. Yet, it seems that if financial services want to make sure that the best advice gets to the widest audience, working with these creators, responsibly, is the best option.

Editor's Note: This article was originally published on pixlee.com. Any statistics or statements included in this article were current at the time of original publication.