It’s challenging to keep pace with the modern consumer. It’s important to understand how customers think, what motivates them and, perhaps most importantly, if they’re satisfied with your brand.

Customer satisfaction measurements are an opportunity to calibrate your brand experience. Are customers happy when they engage with your brand? Are they sharing insights with ratings and reviews or user-generated content? Is something in your customer journey not working or are you missing an experience opportunity?

This is where measuring customer satisfaction (CSAT) can give your brand the insights to make sure you have a full understanding of the people you’re trying to reach. Let’s review the importance of customer satisfaction, how it’s measured, and the ways your brand can utilize that measurement to close any customer experience gaps.

What is the process to measure customer satisfaction?

There are many ways to approach customer satisfaction measurement and, typically, organizing this process involves shared input from different groups like brand, product marketing, digital marketing, IT, and marketing operations.

Your social media team might have sentiment information from your social media management tool to inform a basis for your measurement, while product marketing could have vitally important voice of the customer feedback.

It’s important to bring all this information together first, as it will shape what you know, what you don’t, and where you’re capable of learning more.

Consider these steps when organizing your approach:

Conduct a review: What indicators of current customer satisfaction data do you have access to, and which measurement strategies fit your available resources and needs? Collect what information is already available to your team — like a voice of the customer (VoC) program — and what could serve as indicators across the life of the process.

Create your team: Identify key stakeholders and establish a cross-functional team – particularly those with access to customer data or aligned with brand touchpoints – to drive the measurement process.

Define objectives: Clearly outline the goals and objectives you want to achieve through measuring customer satisfaction.

Choose metrics: Select the appropriate metrics and indicators that align with your objectives, such as survey or focus group data. This step is dependent on what resources or channels are available to you.

Design surveys: Develop well-structured surveys or questionnaires to gather feedback from customers, focusing on relevant aspects of their experience.

Collect data: Implement the survey and collect customer responses, ensuring data accuracy and integrity.

Analyze results: Analyze the collected data to identify trends, patterns, and insights regarding customer satisfaction levels, and consider comparing what you knew to start versus what you learn through each feedback touchpoint.

Take action: Use the insights gained from the analysis to make data-driven decisions and implement improvements to enhance customer satisfaction across your organization.

How is customer satisfaction measured?

Customer satisfaction is typically measured through VoC surveys, feedback, ratings, and reviews. It plays a crucial role in building customer loyalty, driving repeat business, and fostering positive recommendations from authentic brand experiences.

To measure customer satisfaction, you must collect and analyze quantitative and qualitative data from a wide variety of sources, and today’s consumers now have a variety of ways to indicate directly or indirectly as to their satisfaction with your brand.

Each type of measurement offers a different insight. For even more detail, for example, you can look at indirect sources. Some contact center KPIs and metrics, such as first-contact resolution rates, are known to affect customer happiness. On the flip side, retention rates and loyalty are strongly influenced by satisfaction levels.

By tracking a combination of these customer satisfaction measurements, you’ll get a better picture of where you stand with your customers and if you need a plan to improve it. If you limit yourself to only one or two sources, you’ll end up with a false understanding that can lead to misguided business decisions or incorrectly design your customer journey.

Let’s look at six ways you can measure customer satisfaction, and how they support a more complete view of your customer.

1. Surveys

A survey – within the context of customer satisfaction – refers to feedback solicited after a purchase or support interaction, not broad market surveys. Those can be very useful for gauging consumer preferences to inform product development, marketing strategy, etc., but not for this purpose.

Surveys can be presented with self-service results, at the end of a live chat, in a pop-up on your website or mobile app, in an order confirmation email, or even as an option after a phone call with a representative. The more immediately they follow an interaction, the more accurate the results they’ll provide.

Here are some specific examples that are useful for collecting these types of insights.

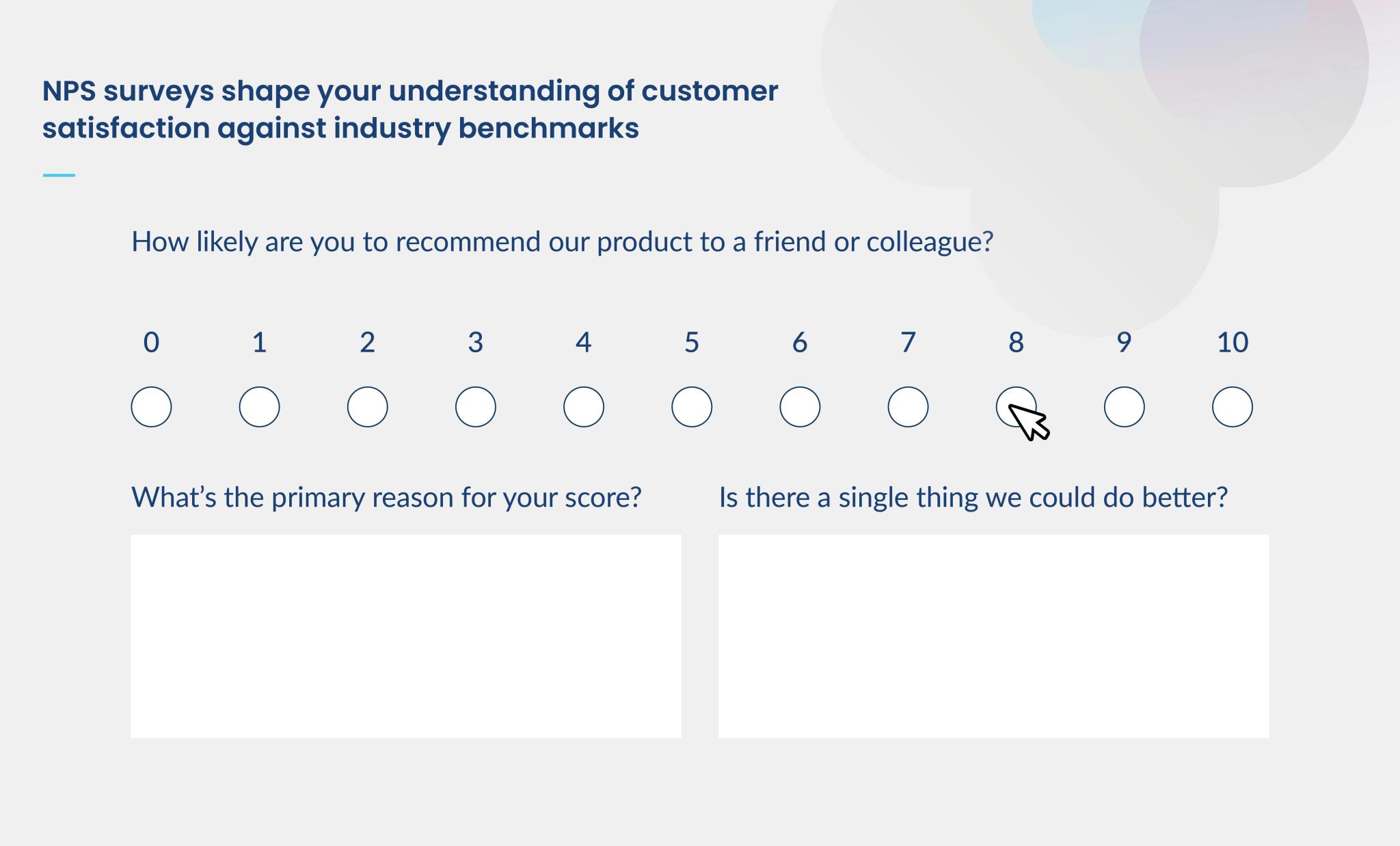

Net promoter score (NPS) surveys

A Net Promoter Score survey is a quantitative assessment of customer loyalty and overall satisfaction, measured by asking customers to respond (using a scale of 0 to 10) to the question, “How likely is it that you would recommend [Organization X] to a friend or colleague?”. NPS is then calculated by subtracting the percentage of respondents who answered anywhere from 0 to 6 (Detractors) from the percentage of those who answered 9 or 10 (Promoters), providing a score anywhere from -100 to 100.

NPS surveys are thought to provide accurate results because customers have an easier time identifying intention than emotion (e.g., “How satisfied are you?”). Also, because they are standardized, you can compare your company against industry benchmarks.

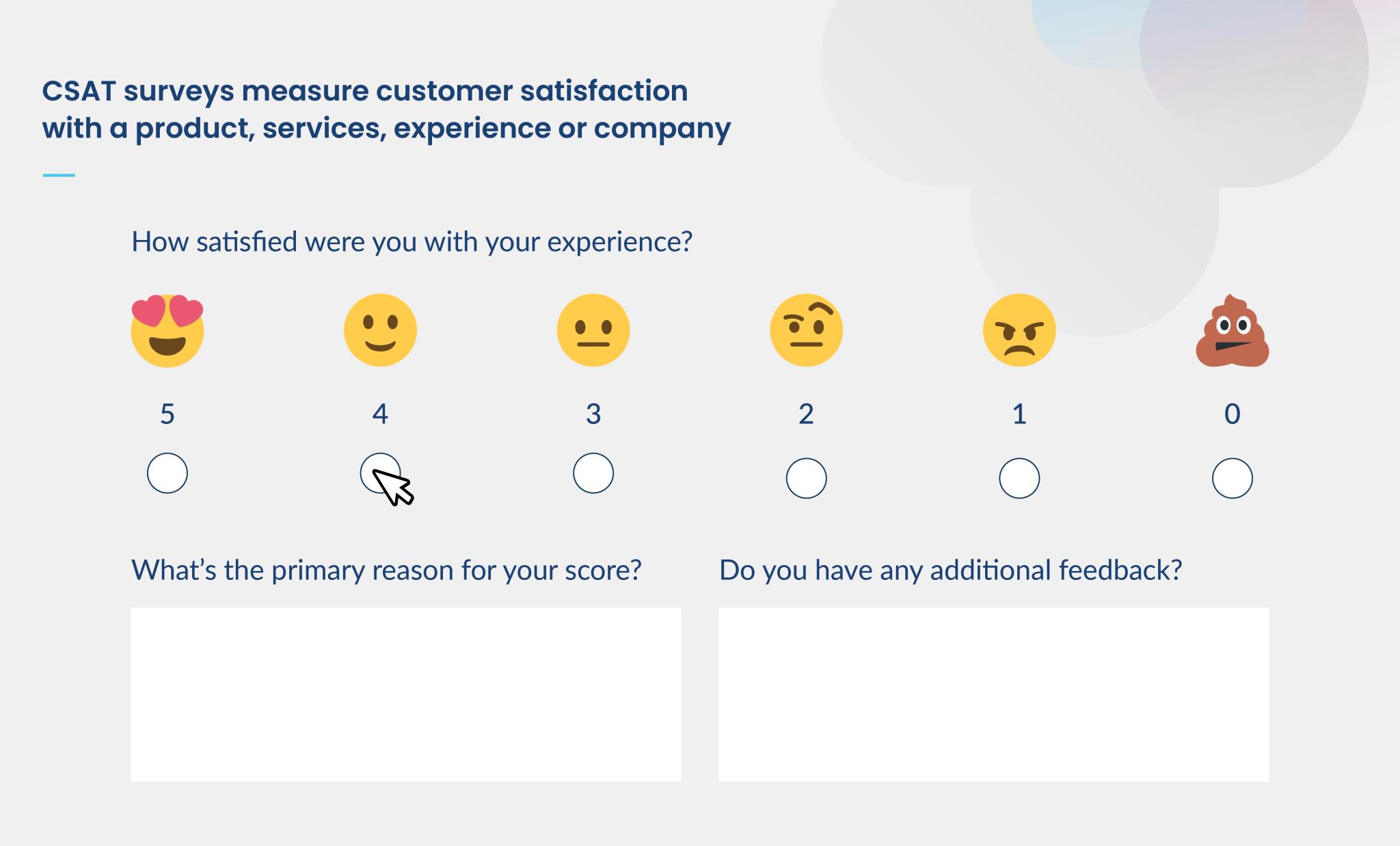

Customer Satisfaction (CSAT) score surveys

CSAT score surveys are also quantitative. By asking customers to rate their level of satisfaction with a product, service, experience, or company, you can effectively measure your brand’s customer journey.

Like NPS, CSAT score surveys only ask one question, but they don’t use a standardized scale, and they’re directed at sentiment. One survey may ask customers to rate a service as “amazing, fine, not satisfactory, or terrible,” while another just offers happy, neutral, and sad emoji faces.

Despite its name, a CSAT score is far from a true measurement of customer satisfaction. Even the customers themselves have trouble estimating their satisfaction in such simple terms, and sentiment is a notoriously unreliable indicator because it’s fleeting and dependent on mood.

Customer Effort Score (CES) surveys

Another way to survey is the Gartner Customer Effort Score (CES), which quantitatively measures the effort it took a customer to get their issue resolved. A customer effort score is seen as a more accurate reflection of satisfaction because it has a stronger correlation to loyalty. According to Gartner, “Customer effort is 40% more accurate at predicting customer loyalty, as opposed to customer satisfaction.”

Qualitative surveys

Surveys can also be used to collect unstructured, text-based feedback that often gives a more detailed picture of customer happiness than structured, quantitative feedback. But while structured data fits neatly into predefined fields, unstructured information needs to be processed by natural language processing (NLP) and sentiment analysis tools in order to provide meaningful insights.

2. Focus groups

Focus groups allow you to hear feedback from your customers firsthand. Depending on the information you’re seeking, those individuals can represent a specific demographic group or reflect the diversity of the customer base as a whole. Because they take place in real-time, focus groups give you the flexibility to dive deeper into issues that come up. But they can also give skewed results if you have outspoken participants who dominate the discussion.

3. Unsolicited feedback

Surveys and focus groups are considered "solicited" feedback, because you’ve asked customers to provide it. Unsolicited feedback, on the other hand, is unprompted. The biggest sources of this data are social media posts, comments, and reviews.

To successfully collect and analyze unsolicited feedback, you need a social listening tool that can track down any mentions of your company, brand, or products. The best tools then use NLP and sentiment analysis technology to filter out the noise and identify actionable information.

Unsolicited feedback has been considered more accurate because people tend to be more upfront with their opinions when they think the company isn’t listening. But as social media is increasingly used for customer service interactions, consumers are discovering that they are being heard. At the same time, they’re realizing that complaining in a public forum can get results when they’ve been failed by other channels. Therefore, this feedback could now reflect more negativity and anger than actually exists across the board.

4. Sentiment and topic trends

Sentiment tracking and analysis is the process of identifying whether unstructured feedback (from customer email, chat and voice interaction transcripts, qualitative survey responses, social media posts, etc.) expresses a positive, negative, or neutral attitude toward any given topic. When you look at trends in sentiment and topics together, you can gain valuable insights into customer satisfaction levels with specific products or aspects of your brand.

5. First-Contact Resolution (FCR) rates

Many customer care and marketing leaders view high first-contact resolution (FCR) rates as the hallmark of call center success.

Before you can feed a high FCR rate into your customer satisfaction measurements, though, you need to dive a little deeper and ask why it’s so high. The study also indicated that of those customers who participated in a brand’s loyalty program, 80% were more likely to download a retailer’s app, were twice as likely to subscribe to emails and push notifications, and 3 times as likely to engage on a brand’s social media presence. Is it because your customers are getting what they need the first time, or is it because they just aren’t calling back? They may have simply moved to another channel, but if you don’t have a 360-degree view of the customer, you won’t know that.

Or they may have gotten fed up and taken their frustration online: 42% of modern consumers surveyed by Emplifi are likely to post a negative rating if they receive an inauthentic customer care experience. According to research from SQM Group, there’s a direct link between FCR and CSAT scores, so make sure you understand how to properly measure, analyze, and improve FCR to stay ahead of potential customer concerns or frustrations.

6. Retention rates and loyalty

Similarly, higher customer satisfaction leads to higher retention rates and increased loyalty. It's why loyalty programs are beneficial for both increasing and measuring customer satisfaction, as these programs offer direction engagement across channels like text, email, and an app.

According to a Wharton Baker WisePlum Consumer Loyalty Study, customers in loyalty programs were nearly 2.5 times more likely to reach out to a company if experiencing a problem, and brand loyalty dropped by nearly 30% when problems arose. However, brands recovered that loss almost fully after a successful resolution.

This means a direct correlation between customer satisfaction and an increase in customer lifetime value (CLV) and a decrease in churn rate. Brands can approach a satisfied customer with repeat purchases, upsells, and cross-sells across their entire relationship.

An investment in customer satisfaction measurement — and taking action on those insights — could mean an improvement in the long-term value of any single customer, and similarly could keep customers from churning.

Each metric – CLV and churn rate – is a good building block for a customer satisfaction measurement plan and, additionally, a touchpoint to monitor as you implement ways to improve customer retention.

According to a Gartner report on customer experience, 44% of customers had concerns about missing better options each time they purchased. With proper measurement and tactics like a loyalty program, your customers won’t be considering those other options.

How Emplifi can help

Emplifi's powerful VoC solution helps brands collect targeted and actionable insights from their customers about their needs, expectations, preferences, and how they perceive their brand experiences at critical moments in their customer journey.

Ready to take your customer satisfaction measurements to the next level? To see our solutions in action, request a personalized demo today.