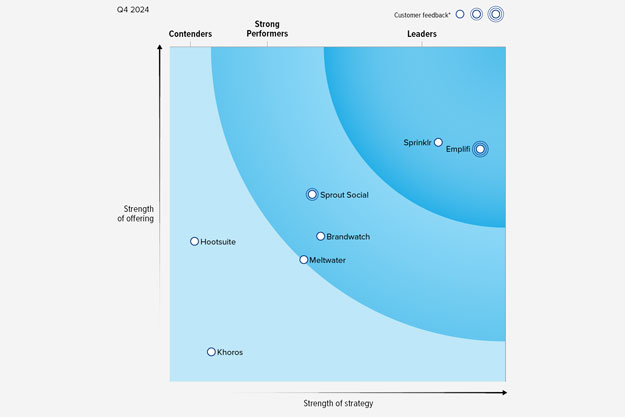

Social media is constantly evolving, so staying ahead of the curve requires data-driven insights. Emplifi’s 2025 Social Media Benchmarks Report analyzes key trends from 2024 to provide guidance for brands looking to maximize their impact in the digital space. This blog post highlights some of the most important findings. For a comprehensive understanding and actionable strategies, download the full report.

Organic performance: Social media benchmarks in platform growth and content trends

Understanding where audiences are growing and which content resonates is crucial for organic social media success. We tracked each major social media channel and examined brand activity to get an idea of what trends we’re seeing over the course of the past year.

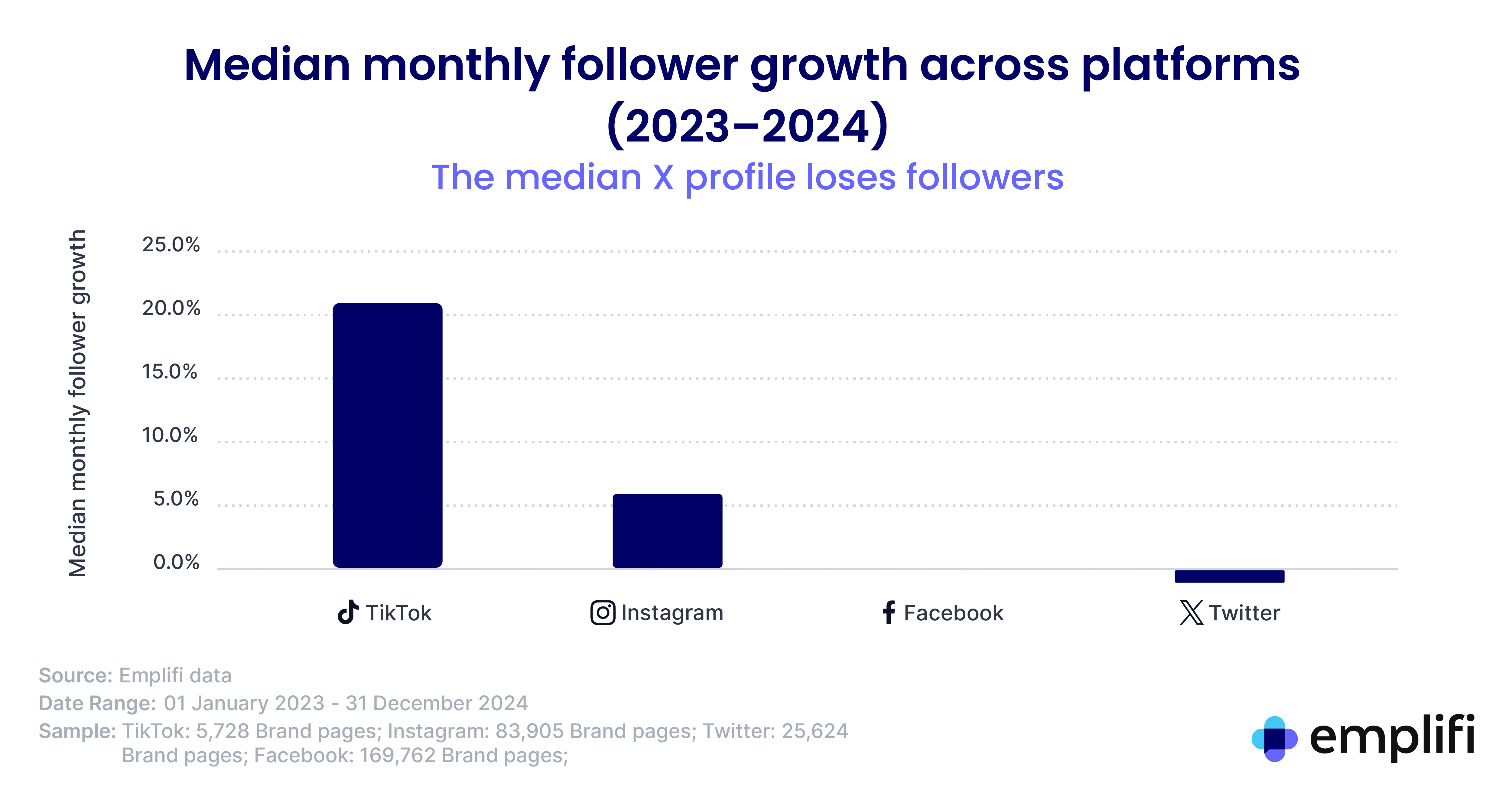

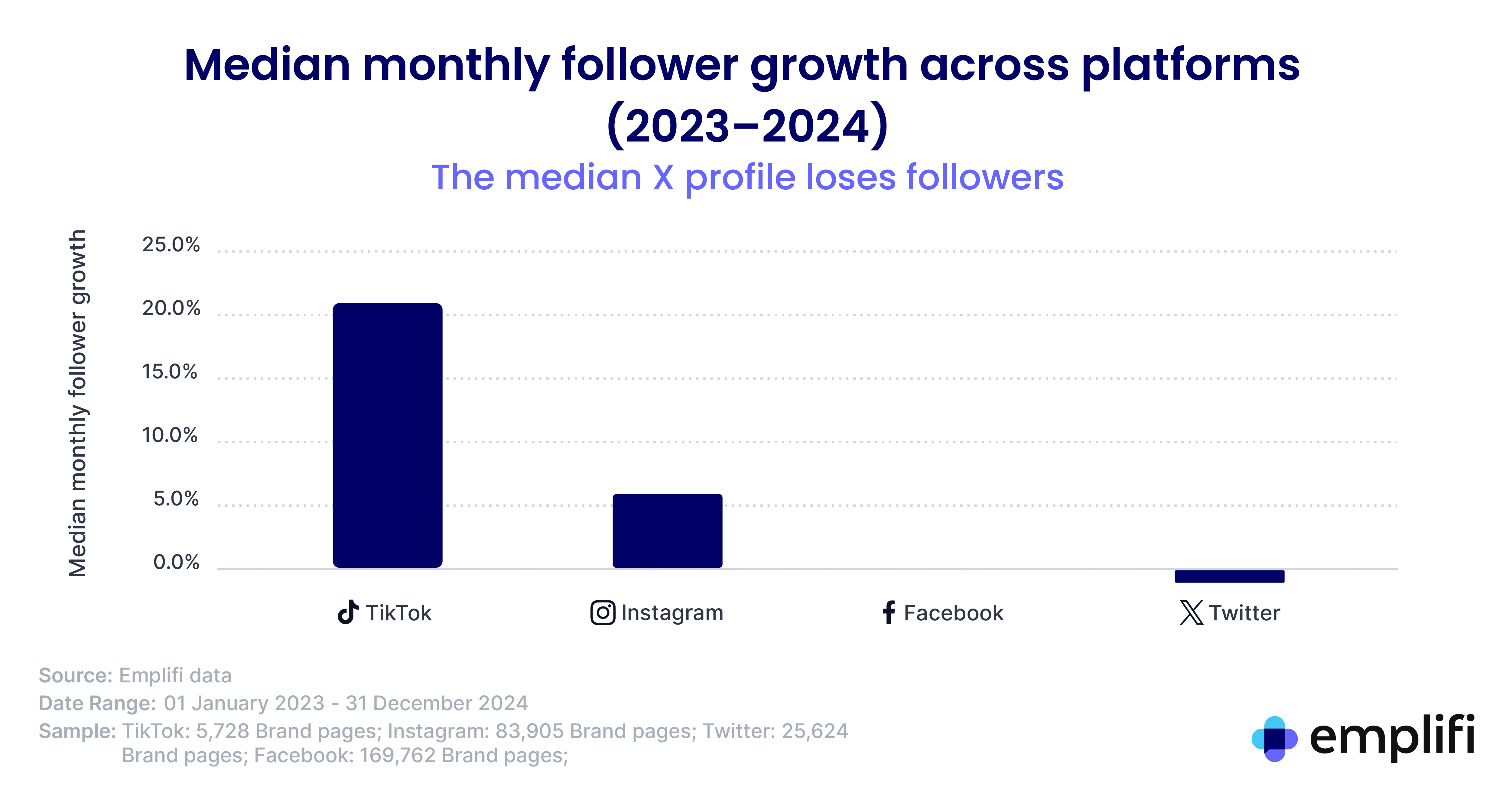

Platform growth and decline

In 2024, social media platforms experienced significant shifts. TikTok led the way, with a median monthly follower growth of 21%, particularly among small and medium-sized brands. Instagram maintained steady growth at 6% per month, driven by the popularity of Reels and collaborative content. Facebook’s organic growth stagnated, reinforcing its transition to an ad-driven platform. Twitter/X continued to decline, with many brands reducing their presence due to diminishing returns.

- TikTok: Prioritize for rapid growth, especially with Gen Z audiences.

- Instagram: Capitalize on Reels and collaborations for engagement.

- Facebook: Still valuable for older demographics.

- Twitter/X: Re-evaluate its fit within your strategy.

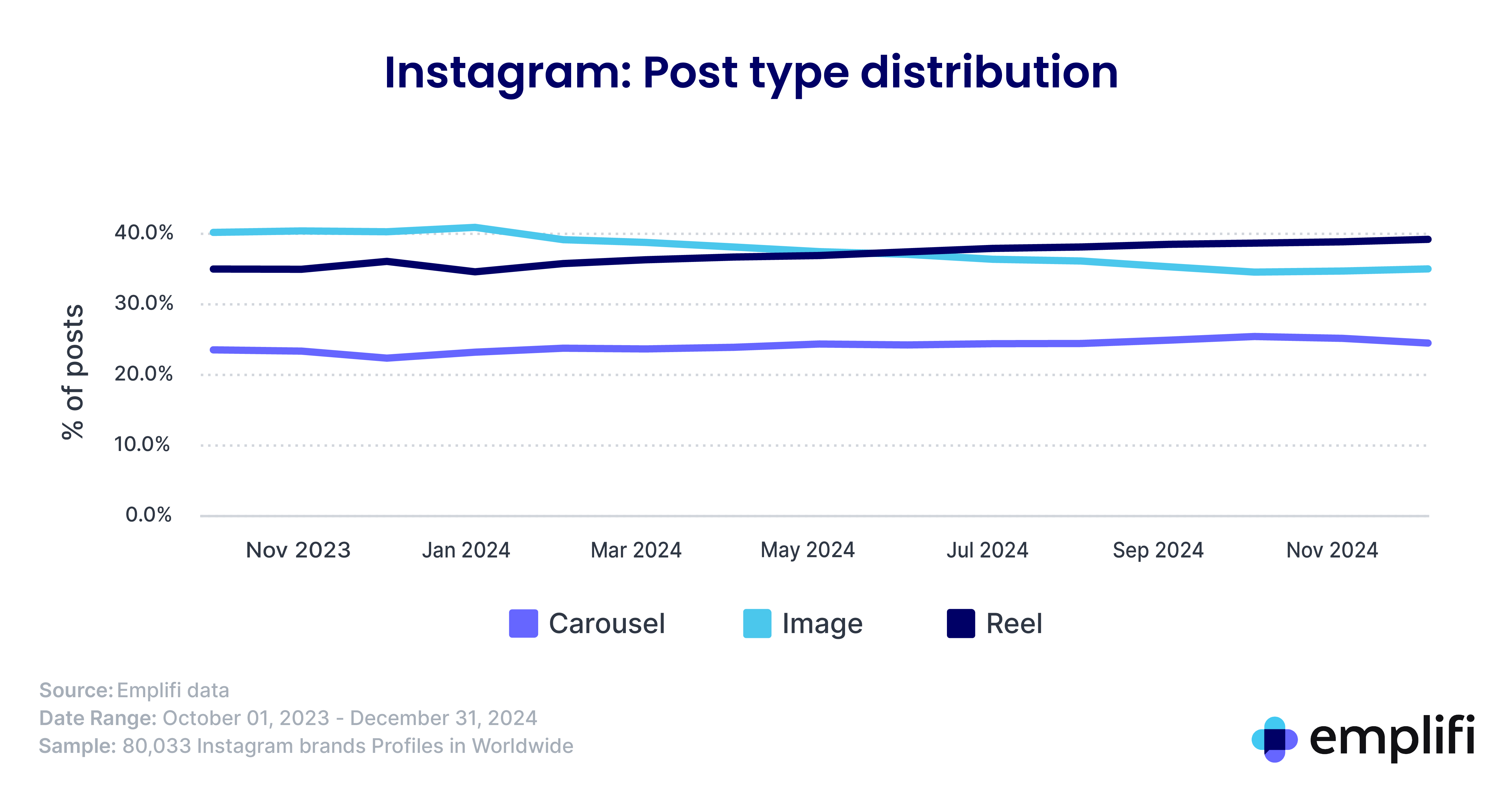

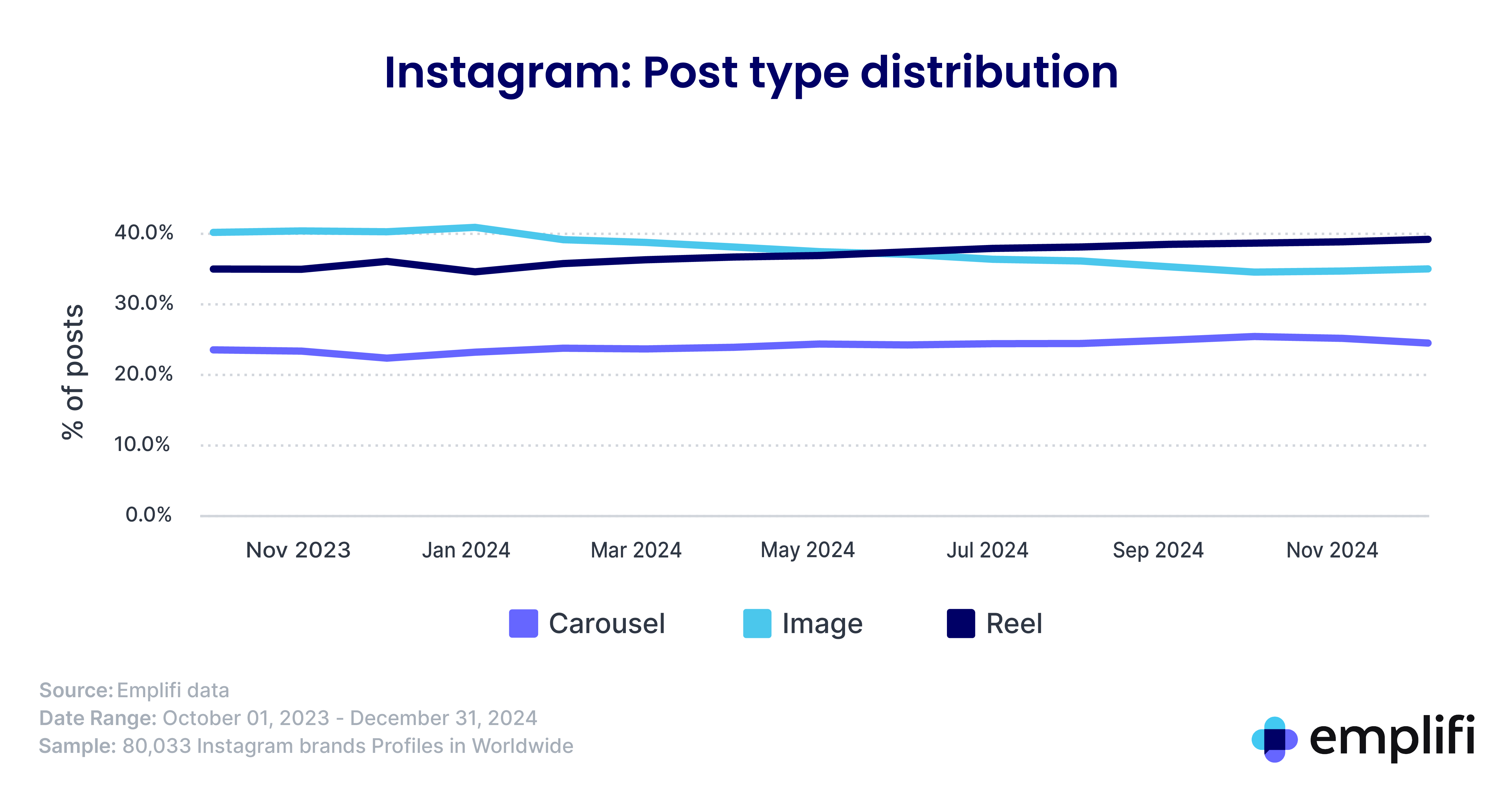

Instagram Reels dominance

Instagram Reels have become a dominant content format, surpassing images in frequency of use. By the end of 2024, Reels accounted for 38% of brand posts, compared to 37% for images. Despite a slight dip in video reach engagement rates, Reels continues to outperform TikTok’s average reach engagement rate.

- Prioritize short-form video content that captures attention quickly.

- Leverage collaboration opportunities to increase reach and engagement.

- Define clear objectives for engagement and reach-focused campaigns.

- Integrate Reels with a broader content strategy.

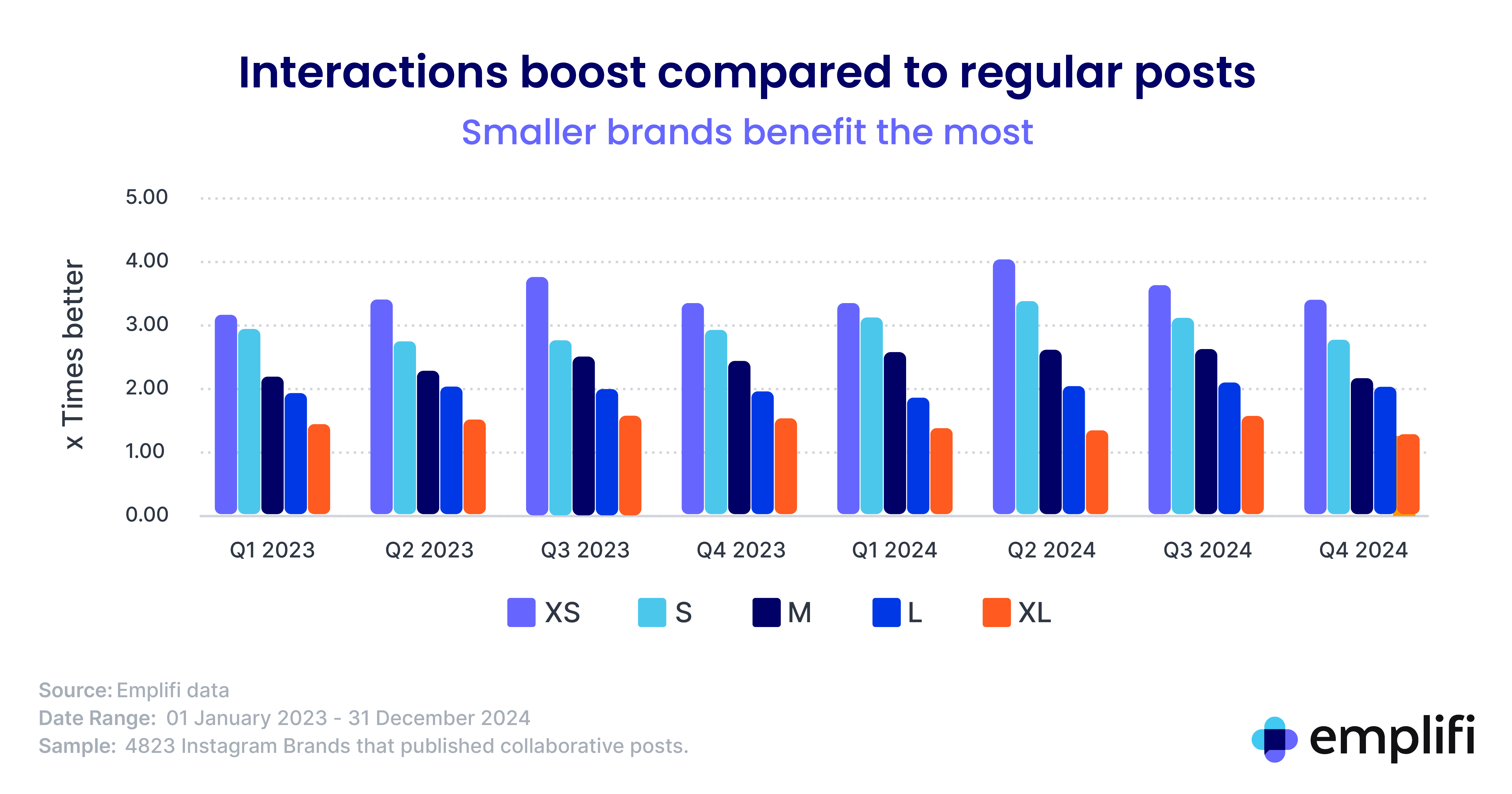

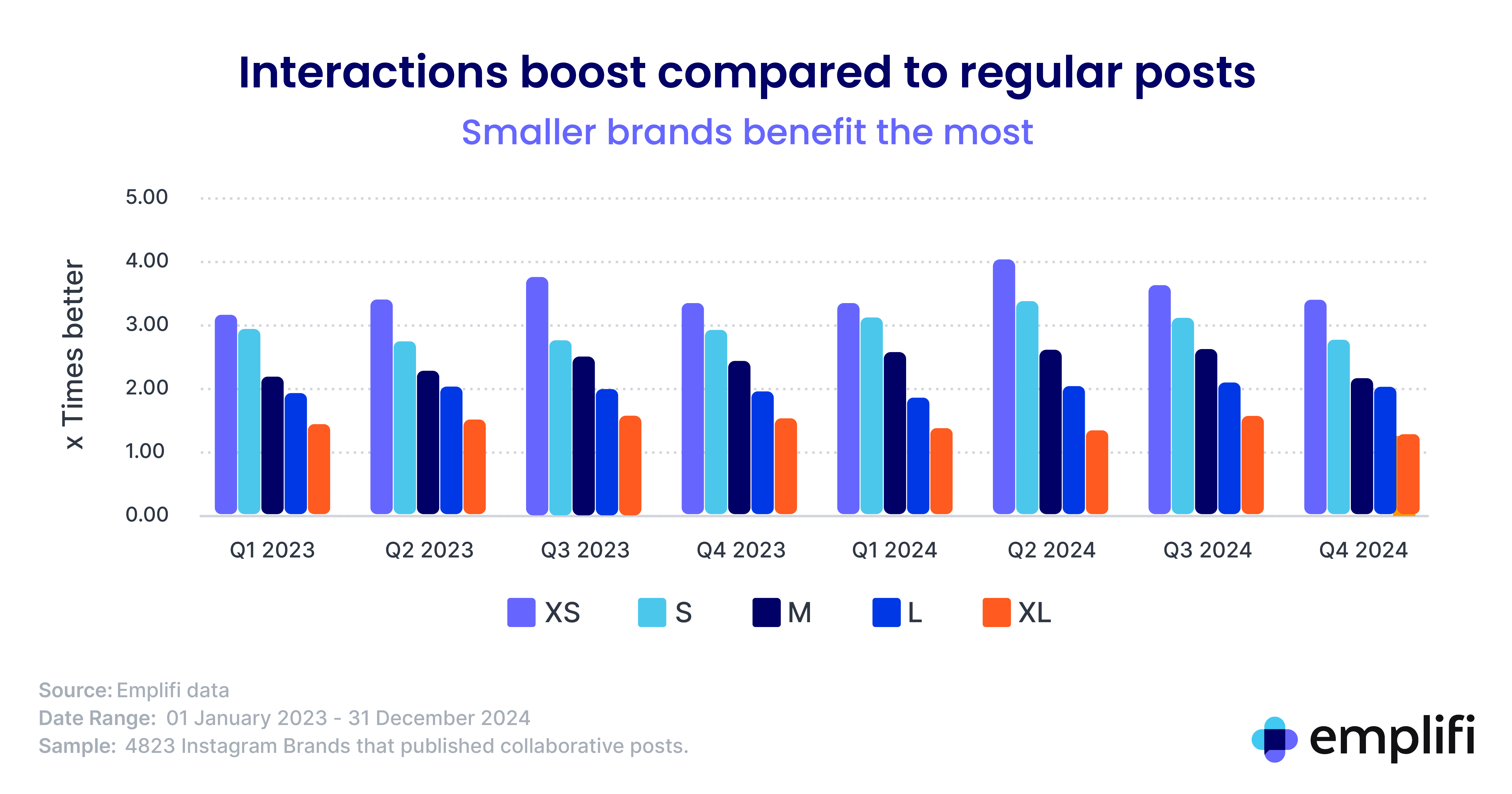

The power of collaboration

Collaboration emerged as a major driver of engagement and reach on Instagram in 2024. The percentage of brands posting collaborative content steadily increased, reaching 4.1% by Q4 2024. Extra Small brands saw a remarkable 3.4x boost in engagement from collaborative posts, while Small brands experienced a 2.7x increase.

- Make collaboration a priority, especially for Extra Small and Small brands.

- Choose partners that align with your brand values and audience demographics.

- Emphasize content quality and authentic messaging.

- Track performance to refine your collaboration strategy.

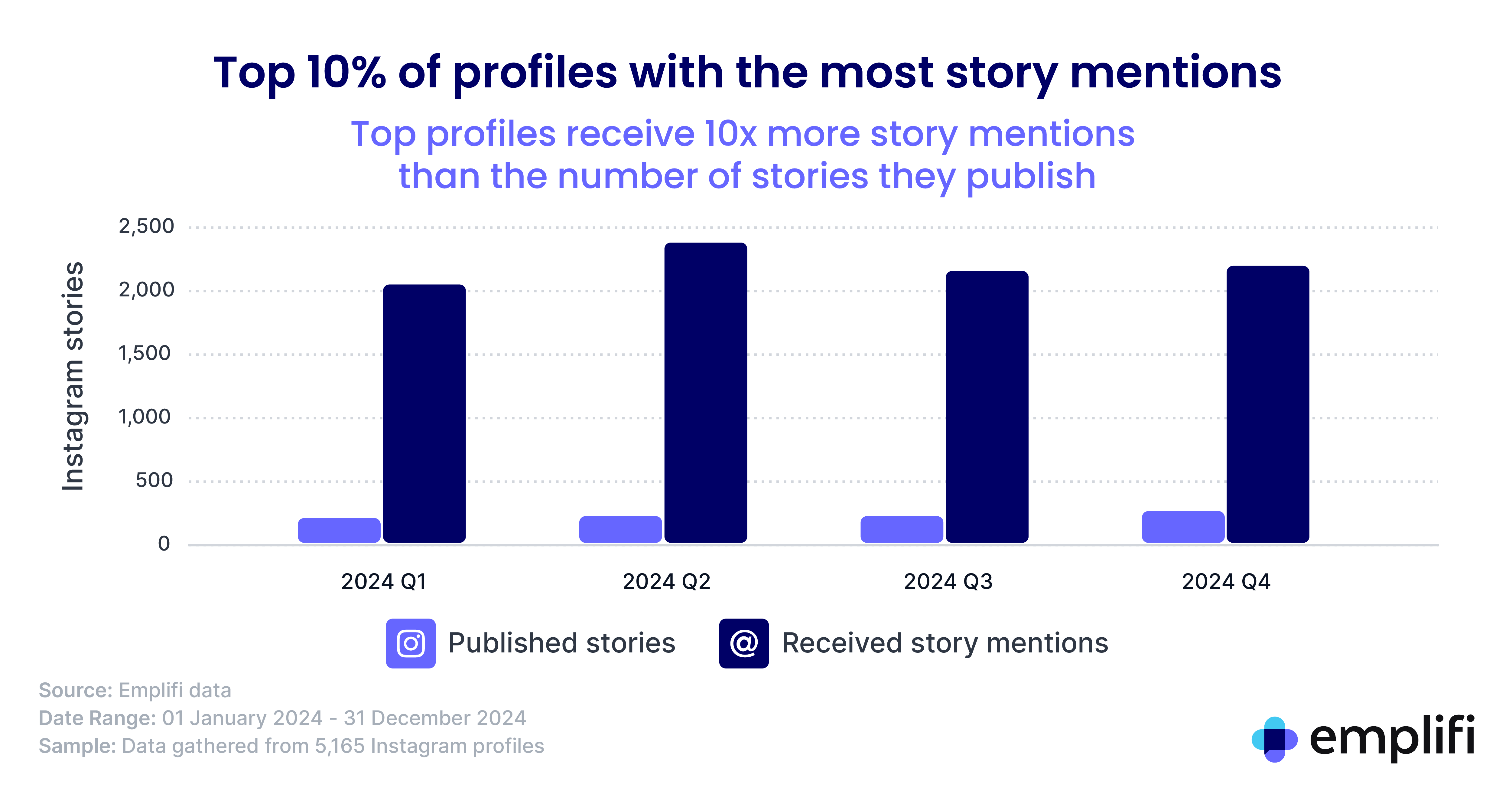

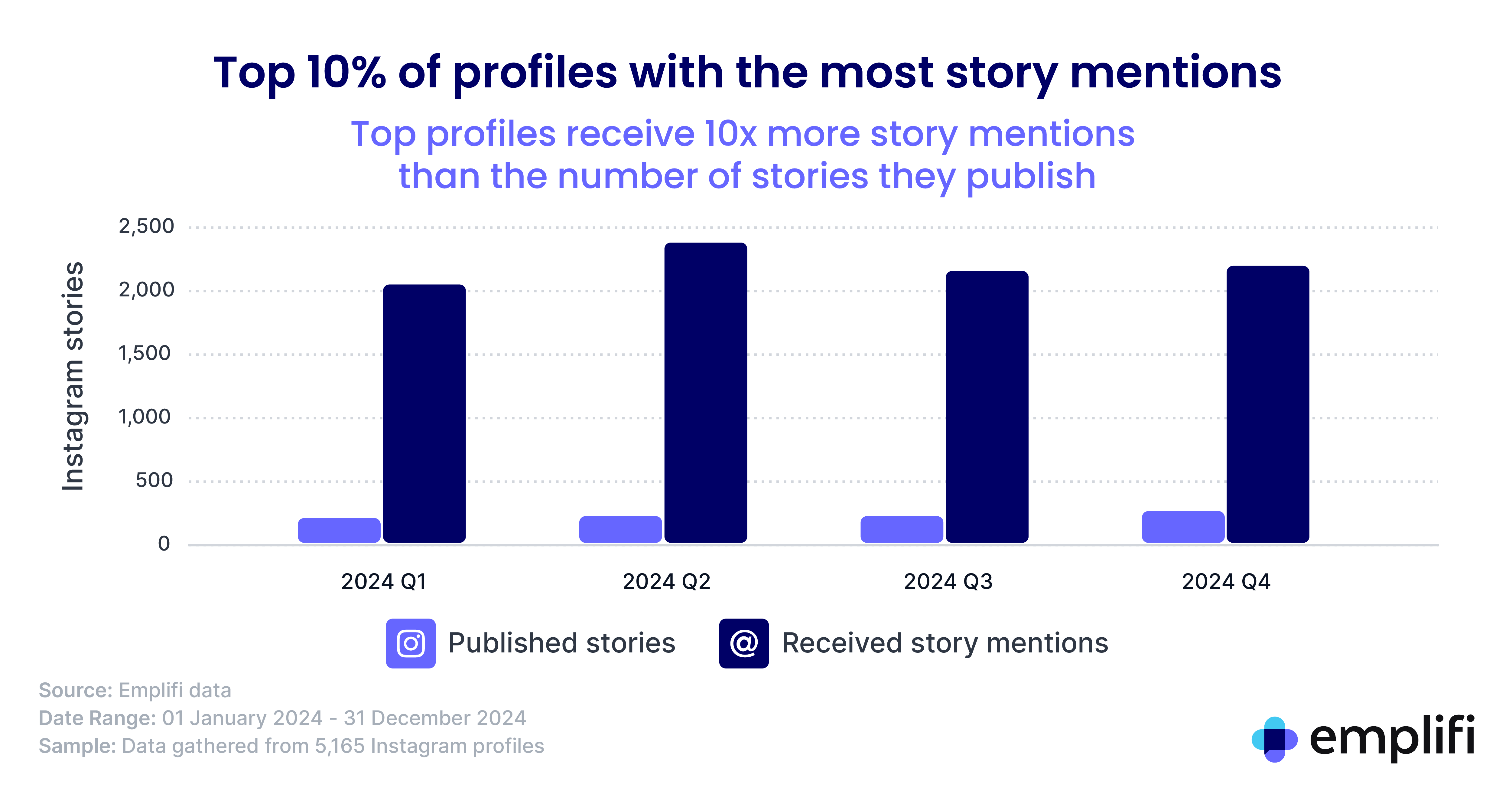

Instagram Story mentions

Instagram Story mentions have become essential for brands seeking to boost visibility and engagement. In 2024, 93% of profiles were mentioned in at least one story each quarter, with the median profile receiving mentions in approximately 70 stories. The data highlights the significance of user-generated content (UGC) through story mentions.

- Encourage story mentions by inviting your audience to tag your profile.

- Engage with mentions by resharing them on your own story.

- Leverage UGC as an authentic, low-cost source of content.

- Be active on Stories to signal that you engage with mentions.

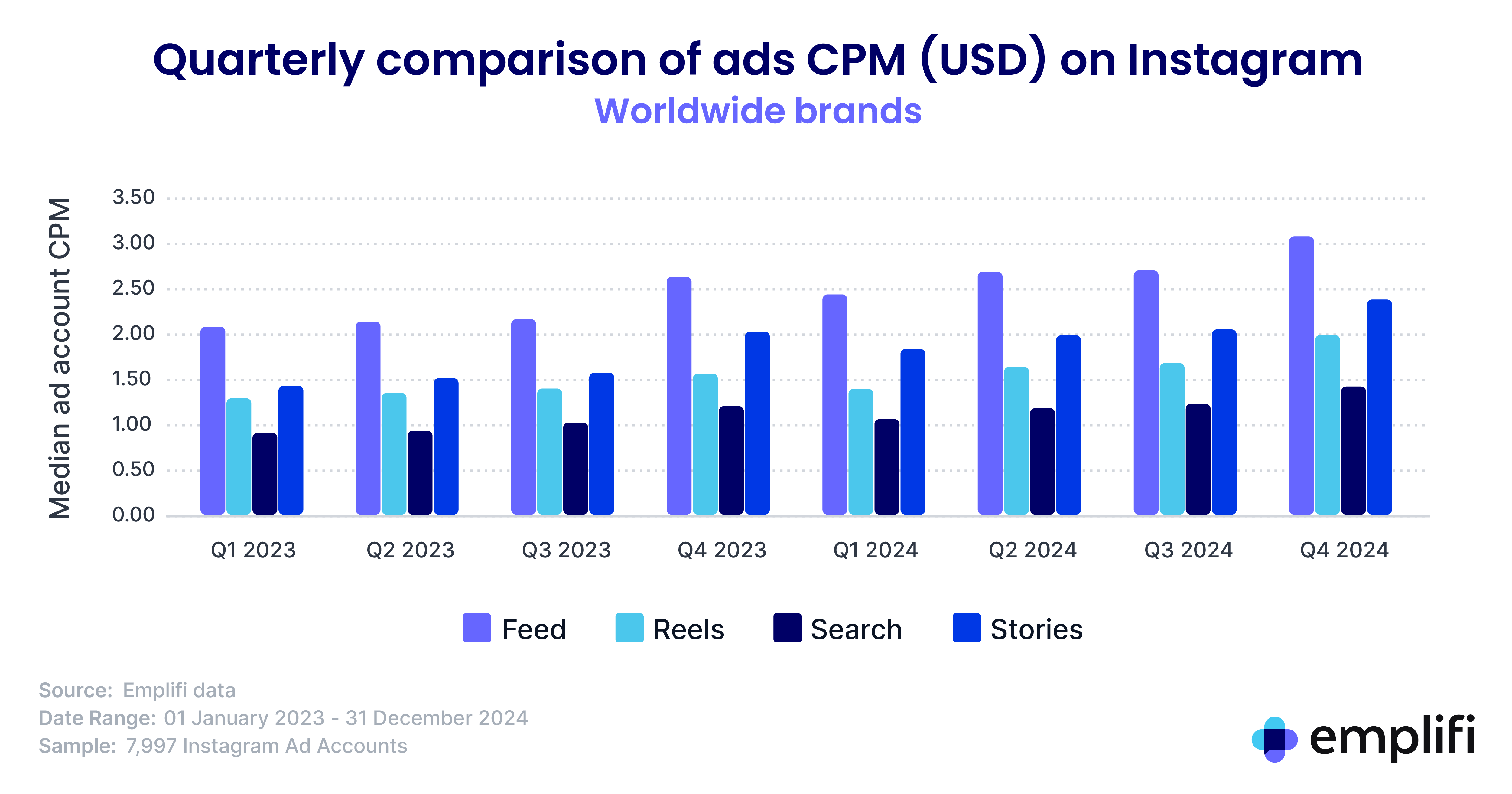

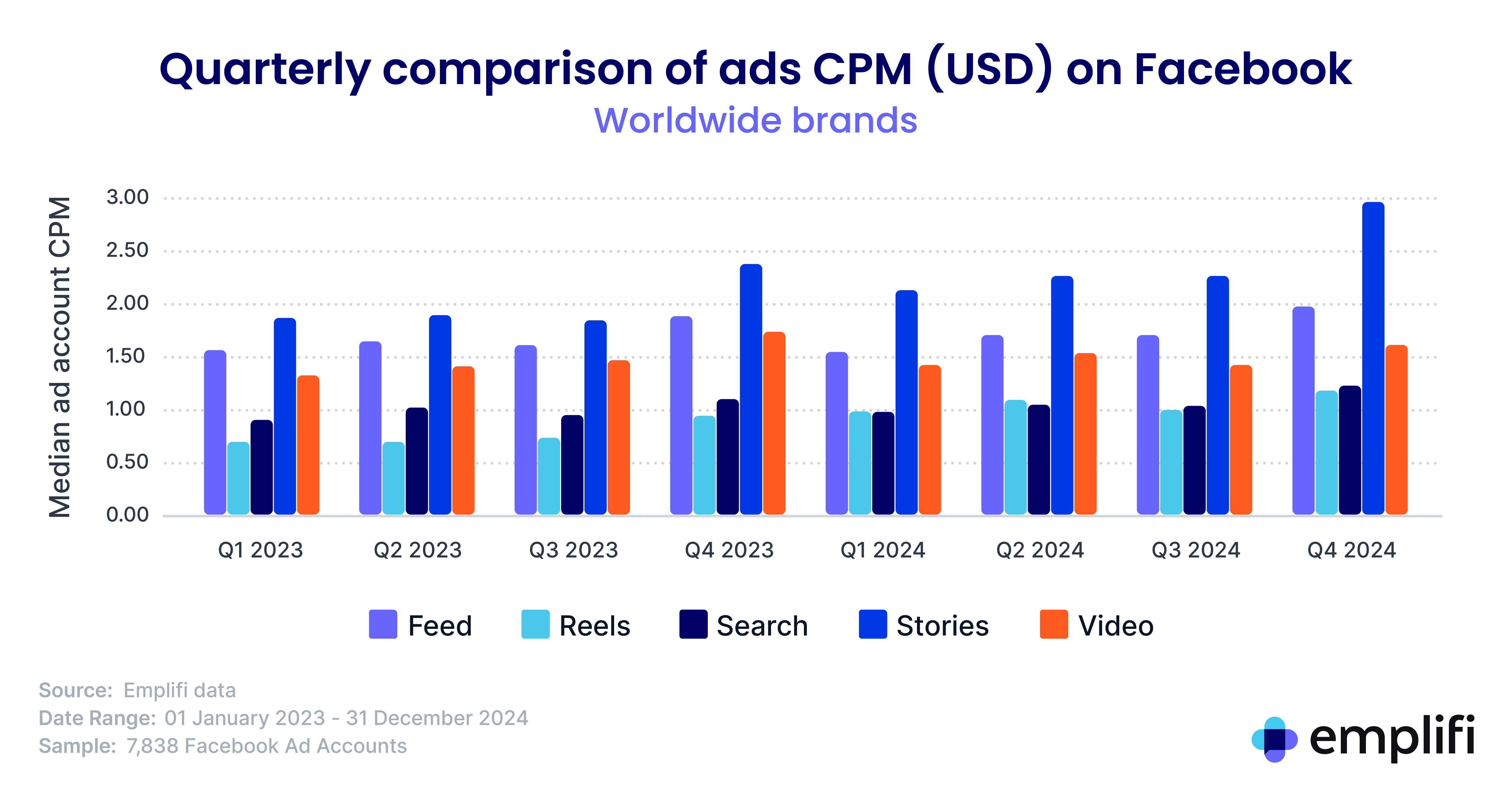

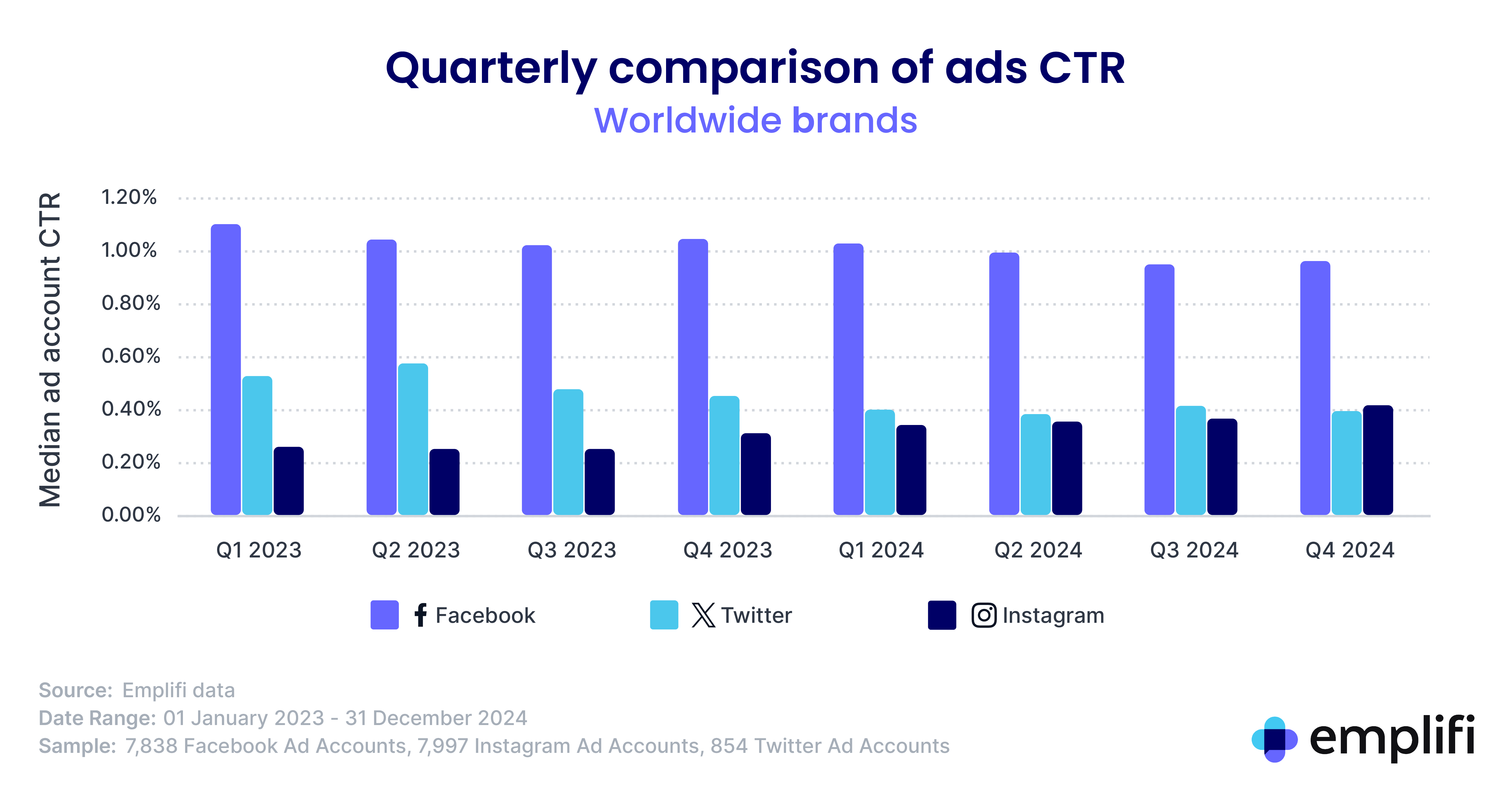

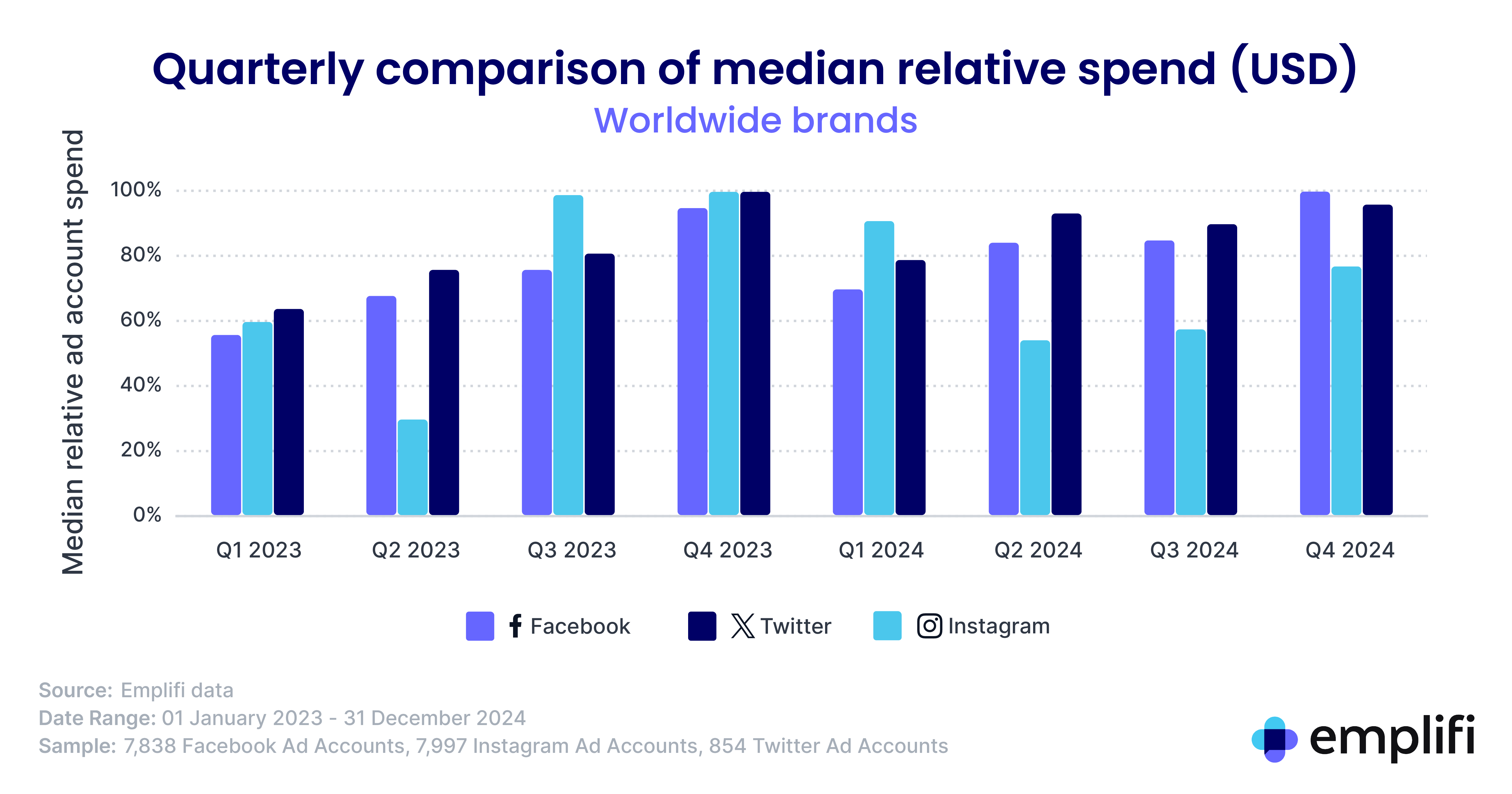

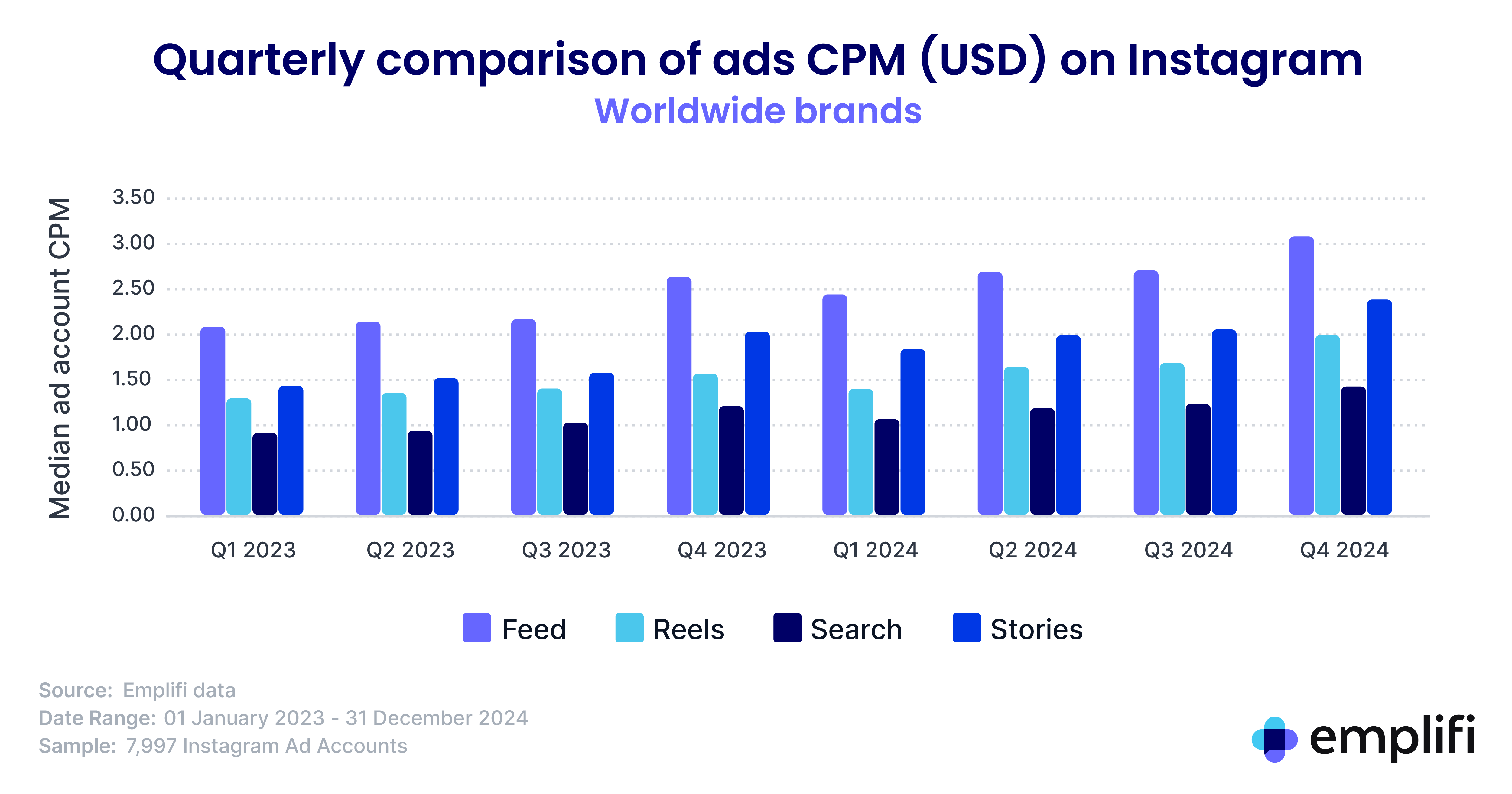

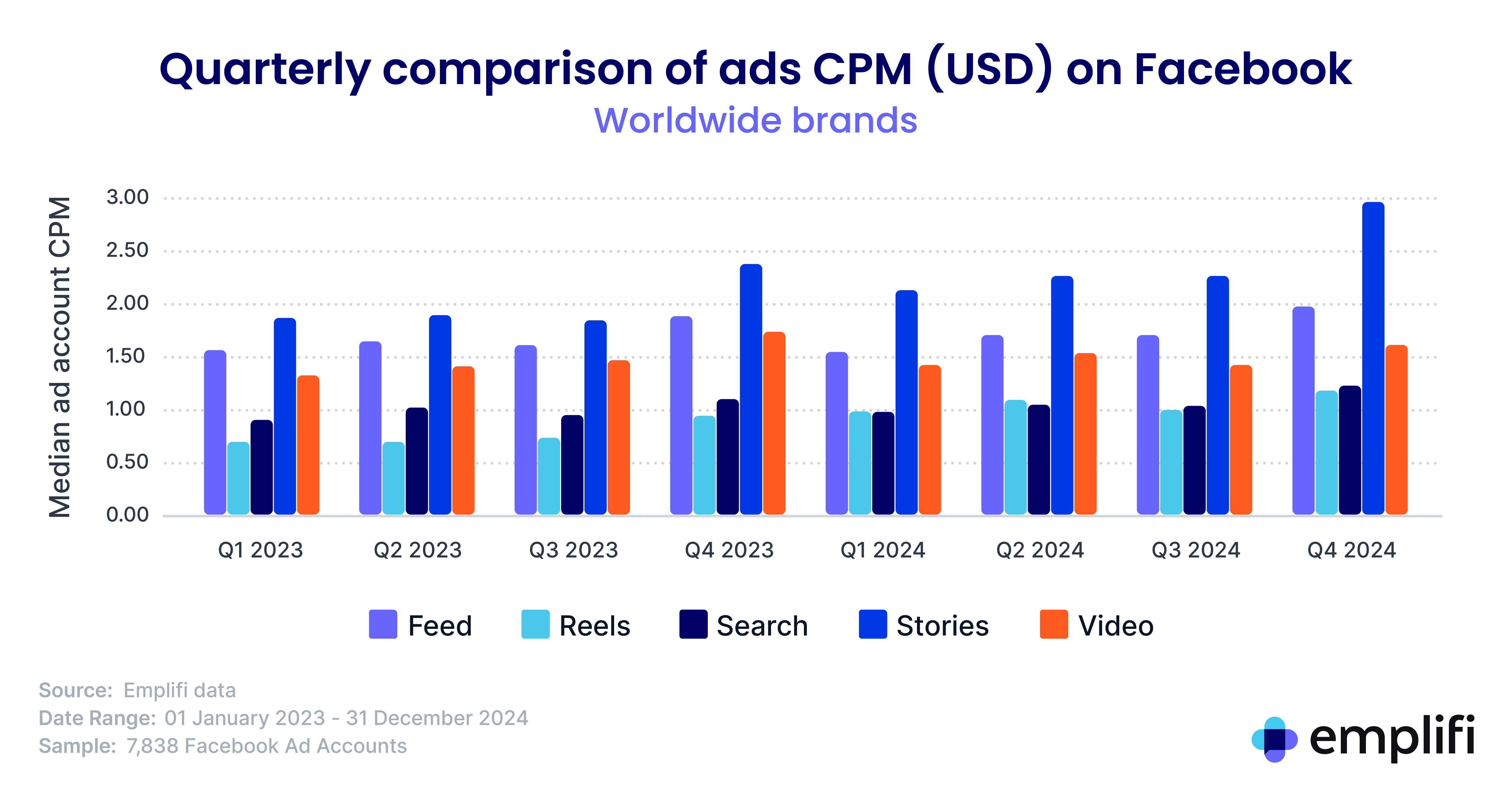

Paid social media benchmarks: Optimizing ad performance with Reels

Reels have not only transformed organic content but also paid advertising strategies. The subsequent sections explore how Reels ads performed on Facebook and Instagram, offering insights into budget allocation and content creation.

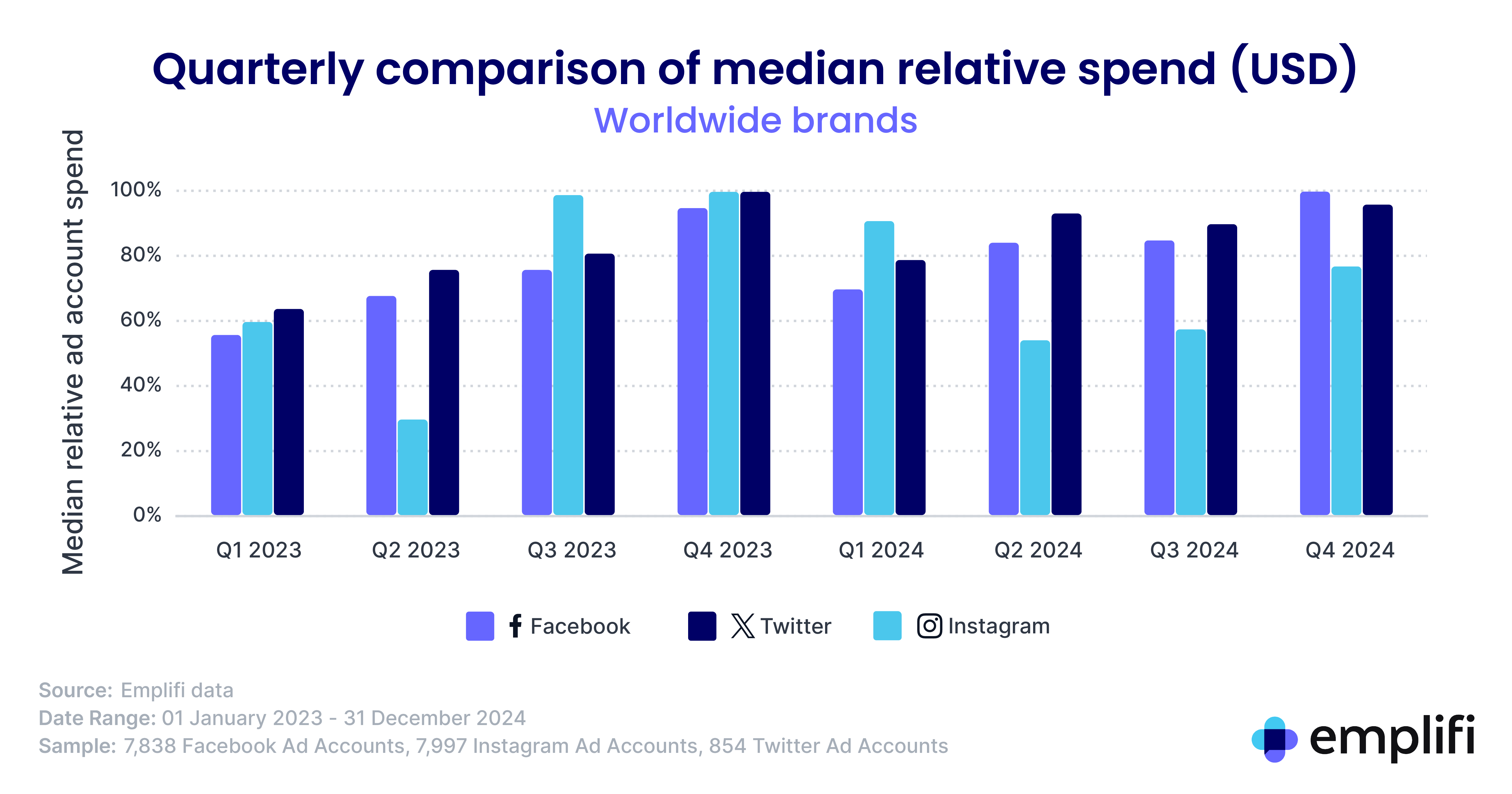

Reels ads: Facebook vs. Instagram

Reels content dominated ad strategies in 2024, with both Facebook and Instagram offering distinct strengths. Facebook Reels emerged as a budget-friendly option for brands seeking to maximize reach, while Instagram Reels excel in engagement. Median ad spend per account on Facebook Reels more than doubled in 2024, reaching $763 by Q4, while Instagram Reels‘ median ad spend was $317.

- Choose based on your goals: Facebook Reels for reach, Instagram Reels for engagement.

- Create platform-specific content: Relatable content for Facebook, visually polished content for Instagram.

- Combine Reels with other formats to diversify your approach.

- Monitor and refine your strategy based on analytics.

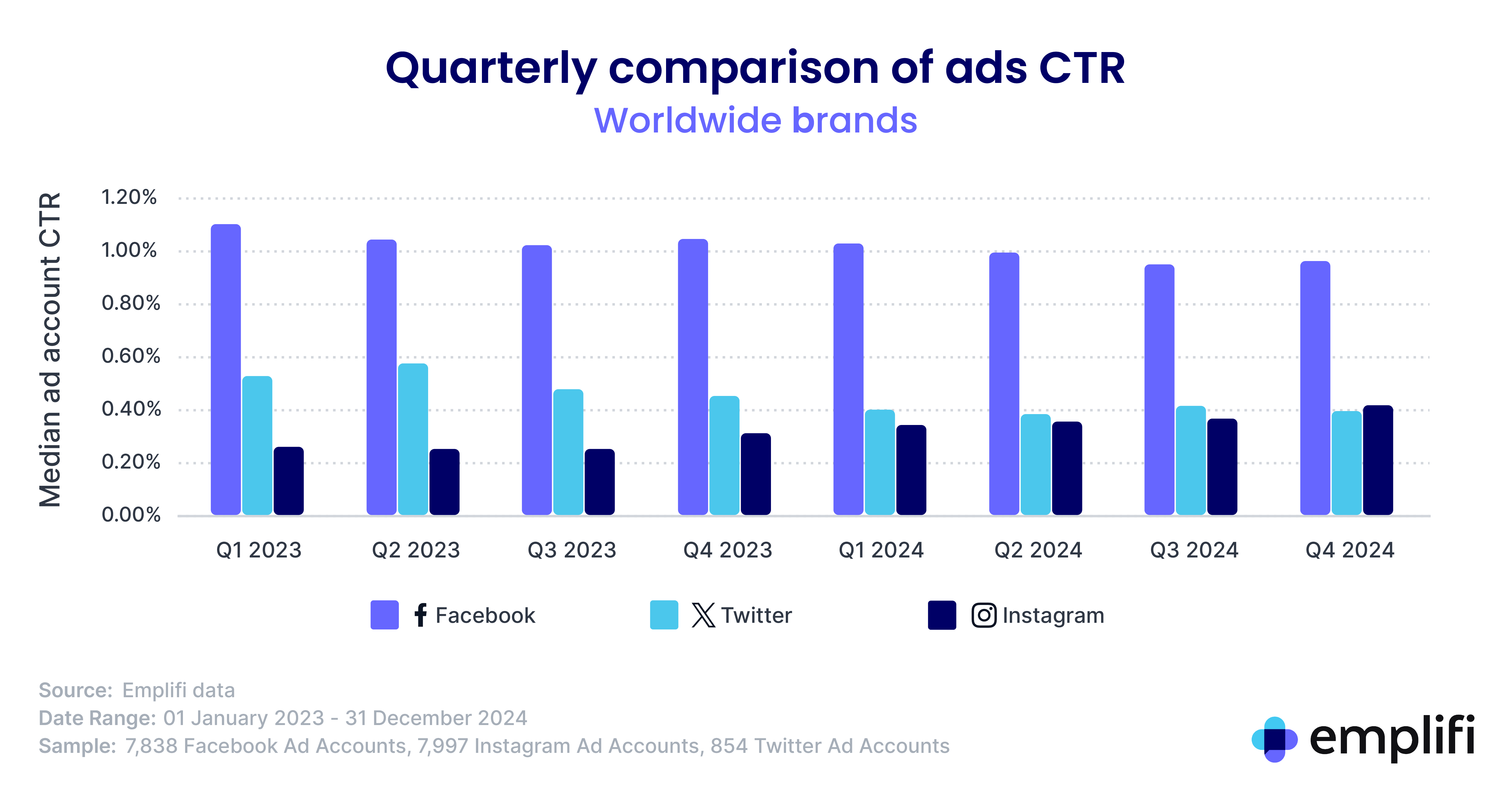

Brand account changes on X

In 2024, there was a decline in brand activity on X, with decreases in active profiles, ad spending, and overall engagement. Ad spending on X also dropped, with many large accounts opting not to run any ads. The platform’s median profile growth was negative, reflecting diminishing returns for brand presence.

- Evaluate X’s impact on your marketing goals.

- Incorporate other platforms like TikTok and Instagram for stronger audience growth.

- Balance video content spend by investing in platforms with higher engagement.

- Monitor platform-specific trends to identify niche opportunities.

Wrapping up: Social media benchmarks

The social media landscape is constantly changing, and brands need to stay agile and data-driven to succeed. By understanding the trends and insights outlined in this report, brands can make informed decisions and maximize their impact in 2025.

Download the full 2025 Social Media Benchmarks Report to gain a deeper understanding of these trends and access actionable strategic guidance.

To discover how Emplifi can help you execute your social media strategy, schedule a demo.